CBA: What are the options?

More experienced investors and advisers can use options and, in particular, collar strategies to provide cost-neutral downside protection where they may be seeking to hold the underlying stock for at least 12 months to be entitled to the CGT discount.

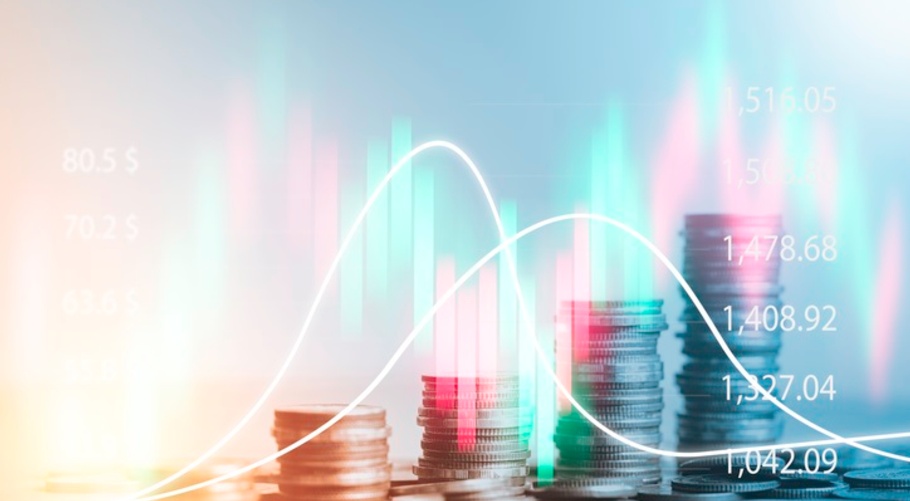

Rebalancing: Portfolio impacts from S&P/ASX 200 Index changes

The upcoming ASX 200 rebalancing highlights how index changes - while routine - may influence trading dynamics, liquidity, and implementation costs, with implications for benchmark-aware portfolio management.

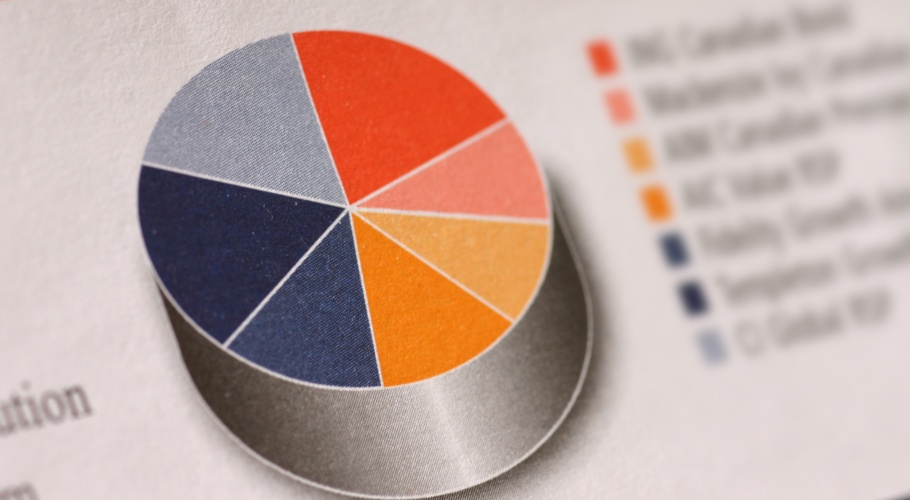

SMSFs and advisers shift to equal-weighted ETFs amid rising concentration risk

Equal-weighted Exchange Traded Funds (ETFs) may offer a useful tool for those pushing to diversify away from pockets of Australia’s increasingly concentrated sharemarket.

Professional investors to add more crypto to portfolios in 2025

Institutional investor appetite for crypto currency may provide impetus for its addition to retail portfolios over time.

Strategies to optimise ETF trade execution

Advisers can improve outcomes for clients with ETFs by following a few simple rules.

Video: AUSIEX discuss the trading strategies of boomers versus millennials

In a recent interview with ausbiz, Chris Hill, AUSIEX's National Manager of Strategic Relationships, shared insights from our latest white paper 'SMSFs Under Advice'.

Advisers buy ETFs and bargain blue chips amid volatility

Advisers bought the dip and positioned for recovery after Liberation Day.

Active ETFs to make more assets available to retail market

Assets in active ETFs are forecast to more than double globally by 2029.

Europe's stockmarket rally may have steam left

There is cautious optimism that momentum may push European shares higher after a strong start to the year.

Advisers look beyond banks and resource companies for gains

Advisers added industrials, big AREITs and a mid-cap ETF to client portfolios in February.

How advisers use ETFs in SMSF portfolios

ETFs are now an investment vehicle of choice for financial advisers and their SMSF clients.

Fixed income ETF listings jump to meet demand

A range of new ETFs provide new options for advisers building bond portfolios for clients.

Global listed infrastructure may provide portfolio counterbalance in year ahead

The sector may offer more attractive valuations than broader indices used to measure market performance.

Private debt boom reaches the ASX

The number of listed investment trusts which allow advisers to add private debt to clients’ portfolios is growing.

Australian small companies on investors' radars in 2025

Analysts are optimistic local small caps will have a solid year if the market environment turns in their favour as anticipated.

Bank hybrids may still stack up for investors

The popular securities may remain attractive investments until they are phased out next decade.

Stock selection key to investing in 2025

Expectations for shares next year are mixed – but pockets of the market may deliver better gains than others.

Most read on AXIS 2024

Our most read content from 2024.

Where to find the highest dividends in 2025 – both in Australia and offshore

The highest dividends in the third quarter were paid by companies from global markets including the US, Hong Kong and Australia.

Dual access funds: how to choose the best option

Advisers can now more often choose from listed and unlisted versions of the same fund depending on their clients’ needs.

European sharemarkets under the microscope

The region’s shares can get lost in the news about global markets.

How to get a strangle-hold on the market

Many investors are currently eyeing potential near-term catalysts coming at the back end of the year.

US election unlikely to impact long term investments

Diversified portfolios have delivered positive returns in most US election years even if there is volatility in the lead up to voting.

What to expect in the ETF market over the next decade

All eyes are on the Australian exchange traded fund market as it develops new products to meet demand from advisers and their clients.

Economic outlook may bode well for global small companies

Some analysts have pinpointed global small caps as a sector to watch as interest rates decline.

Why offshore-listed ETFs can broaden investment horizons

Exchange traded funds listed in the United States and Europe include strategies not available in Australia.

Reporting season reveals companies likely to outperform

The recent earnings season gave a strong indication of both the market outlook and prospects for individual stocks.

Where to next for the big four?

AUSIEX asked John Lockton, Head of Investment Strategy at Sandstone Insights, to answer key questions about the banking sector.

Strategies to combat market volatility

A number of tools allow advisers to offset the risk of further market dips.

Cboe may offer advisers a different route into popular asset classes

Cboe may offer advisers a different route into popular asset classes.

Top tips for trading international shares

Trade execution is almost as important as stock selection in global markets

New integrated reporting solutions to drive more than productivity gains

Recent research has found that ‘superior reporting’ was among the top reasons more than a third (38%) of clients switch to a new financial advisor.

Navigating the rise of female wealth custodians

The growing number of female millionaires provides an opportunity for advisers to expand their client base.

How advisers can better help investors play the AI theme

Should investors buy direct shares of Nvidia, in particular, buy the dip when its inflated share price drops with market volatility, or take a different approach?

Video: Why are Australian public equity markets underperforming?

AUSIEX CEO, Patrick Salis, appeared on ausbiz TV to discuss how effectiveness of Australian public equity markets in elevating businesses from startup to significant economic contributors could be vastly improved.

What fund managers expect in the second half of 2024

Three fund managers give an insight into markets for the second half of 2024 and beyond.

Australian equity capital markets could be better used to generate wealth and opportunities for all

Patrick Salis, CEO of AUSIEX, writes that the role of equity capital markets in Australia in bringing businesses from startup to capital markets is not working as effectively as it could.

Zero Day Options in the Australian Market

Should Zero Day options be listed a week in advance on a daily basis, or be listed at the beginning of each trading day to expire at the close? There are benefits to each approach for different industry stakeholders.

Global versus local: emerging markets re-emerge

Australia’s biggest institutional investors have tended to hold more overseas stocks than local ones for decades. Individual investors are now starting to catch up.

Options can add extra dimension to financial advice

The ASX in conjunction with the Stockbrokers and Investment Advisers Association (SIAA) provides scholarships for advisers to undertake the necessary training to become an accredited derivatives adviser. AUSIEX can help facilitate these scholarships.

Helping investors by protecting bank stocks with options

Citi’s recent decision to downgrade all listed Australian banks to “sell” was the first time it had been so bearish on the sector since February 2015.

Advisers add European equities to portfolios in 2024

The outlook for European mega caps is one factor driving investment in the region’s sharemarkets.

Where Australia's sovereign wealth fund is investing

The $223 billion Future Fund made significant new investments in equities over the past year.

Cautious outlook for bonds – but opportunities exist

A cloud over the likely direction of inflation and interest rates has implications for fixed interest portfolios.

Next steps for advisers in intergenerational wealth transfer

An AUSIEX white paper provides key insights into the opportunities and challenges for advisers as Baby Boomers pass on their wealth to heirs.

How trading technology is helping financial advisers navigate markets

Trading technology is helping financial advisers navigate markets, writes Brett Grant, Head of Product, Marketing and Customer Experience at AUSIEX.

Choosing technology – which is right for you?

Choosing the right technology and vendors can make a real difference to the ability of advisers to service SMSF clients efficiently and cost effectively, writes Chris Hill, National Manager, Strategic Relations at AUSIEX.

Self managed super fund investors turn to advisers amid market uncertainty

A deep dive by AUSIEX into the composition and trading habits of advised self managed superannuation funds provides valuable intelligence for SMSF advisers.

Which stocks are popular with SMSF investors?

The answer depends on whether they use a financial adviser.

Video: AUSIEX release new findings profiling advised SMSF clients

AUSIEX National Manager of Strategic Relationships, Christopher Hill, spoke to Danielle Ecuyer on ausbiz TV recently to discuss analysis from AUSIEX’s latest research paper 'SMSFs Under Advice'.

Video: AUSIEX discuss the acceleration of intergenerational wealth transfer

AUSIEX Head of Sales, Trading and Customer Relationships, Te Okeroa, spoke to Juliette Saly on ausbiz TV recently to discuss AUSIEX’s new updated paper 'On the Precipice of Change - Preparing for Intergenerational Wealth Transfer'.

Global dividends set to rise in 2024

High-quality international companies offer attractive yields as well as upside potential for capital gain.

Earnings season under the microscope

Company profits mostly surprised on the upside – but it pays to dig deeper into the results.

How to invest in alternatives with listed products

The stockmarket offers more than just access to public equities.

Using Options to Repair a Stock Position

The use of a “Stock Repair” strategy can potentially be a handy tool when managing your portfolio, providing a faster path back to break even, than simply holding stock alone.

Why global infrastructure might bounce back

Experts argue economic conditions and secular trends bode well for infrastructure equities.

How to get selective with US stocks in 2024

Advisers may find value in unexpected quarters of the world’s biggest sharemarket.

What fund managers expect in 2024

While the market outlook remains uncertain, there will be some bright spots next year according to experts.

Most read on AXIS 2023

Our most read content from 2023.

US shares can pay dividends too

International equities sometimes get a bad rap for lacking the income offered by Australian stocks. But dividend-paying companies do exist offshore.

Volatile conditions spur potential investment strategy rethink

Professional fund managers and advisers alike are reconsidering tactical asset allocation in the current market environment.

Is it time to hedge global equity investments?

The slide in the Australian dollar has raised the perennial question of whether it’s worthwhile hedging for currency risk.

Fund managers eye small companies

An improved earnings outlook is one factor piquing interest in stocks outside the biggest names.

Video: AUSIEX partners with Saxo Australia

Our CEO Patrick Salis spoke to Danielle Ecuyer on ausbiz TV recently to discuss AUSIEX’s new partnership with Saxo Markets Australia.

How active equity managers are performing in 2023

It was forecast to be a year for active managers to shine – so how are they tracking?

Keep an eye on real interest rates in portfolio construction

The timing of any reduction in official interest rates could be a key concern for equity investors in the months ahead.

Earnings season report card – which companies delivered?

Three market commentators spoke to AUSIEX about the upshot of the August reporting season.

US market may turn up more opportunities than just AI

Investors who have ridden the wave of technology gains may look to reposition their US holdings.

How to set asset allocation in an uncertain world

There is more to portfolio construction than a simple division between shares and bonds.

Mid caps can add extra dimension to blue chip portfolios

The long-term gains of this overlooked section of the market suggests it should be on the radar of advisers and investors.

New option strategies for global investors

As market volatility increases, so too is options trading over international ETFs.

Data snapshot: what stocks have been the most traded on the ASX?

Just because a stock is one of the largest on the ASX does not mean it’s one of the most traded. The exception is BHP, which was the most consistently traded stock week in, week out, over the past few months.

An underutilised tool in income investing – ASX Options

Savvy advisers and investors are tapping the local ASX options market for a supplementary source of income in addition to dividends and fixed income.

Buy, sell or hold? Australia's biggest stocks under the microscope

The prospects for Australia’s most commonly held shares are a major consideration as investors position their portfolios for 2024.

What will the year bring for investors?

Five experts reveal their market outlook plus their expectations for the upcoming earnings season.

Where to next for fixed income ETFs after bumper inflows

Fixed income emerged as an asset class of choice for investors over the past year. Has the outlook for bonds now changed?

Little relief in sight for Australian bank shares

The big four banks delivered solid first-half results but headwinds have dimmed the sector outlook. What does it mean for shareholders?

Outlook ripe for active ETFs to prove their worth

Just having capital is no longer enough to generate decent returns via beta, according to Australia’s Future Fund. So, what does that mean for financial advisers?

How to build a truly global portfolio with ETFs

The large number of Exchange Traded Funds dedicated to international shares belies the home bias that can potentially dominate the portfolios of Australians.

Intergenerational wealth transfer set to accelerate

The unprecedented transfer of wealth from Baby Boomers to other generations has picked up pace and provides a challenge and opportunities for advisers.

Why some experts believe small caps may be ripe for revival

There is increasing interest outside the top ASX stocks as local small companies come back onto the radar – is it justified?

Video: Options give you options

Options give investors more options: In a recent interview with Andrew Geoghegan on Ausbiz TV, AUSIEX Head of Sales, Trading and Customer Relationships, Te Okeroa, discusses how options trading may provide not just protection, but income for investors in an upward rates cycle.

Key takeouts from reporting season

Five experts give their verdict on the recent ASX reporting season.

Asian tigers set to earn their stripes

Key indicators point to a better decade ahead for regional share markets

Quality is the best defence in volatile times

As market uncertainty continues, financial advisers can expect a raft of questions from clients.

Bears and Butterflies: Two ways to trade a falling market

There are a thousand ways to skin a cat and there are a similar number of ways to use options to gain a directional exposure to equity markets. The intention of this article is to compare 2 strategies to play a falling market, discussing the pros and cons of each, as well as the common pitfalls and important considerations.

Fixed interest resurgence fuels ETF innovation, inflows

Exchange traded funds (ETFs) with a focus on fixed interest were among those that benefited most from renewed appetite for fixed interest over the past 6 months as investors looked to build allocations to an asset class that suffered an atypical decline in 2022.

Reducing volatility with better ESG assessments

Risk management has always been part of financial advice and investing. It is now more important than ever. As are new risk assessment tools.

Advisers turn to capital notes to generate more investment income for clients

There are ways to generate regular and consistent income for investors other than just fixed income and dividends. Advisers have been turning to capital notes, according to AUSIEX data.

SMSF funds look to financial advisers to navigate market turbulence

A new analysis of SMSF clients reveals the areas where they most need professional support.

Most read on AXIS 2022

Our most read content from 2022.

After a year of turmoil and change, what may lie ahead in 2023?

There is little doubt with interest rates on the rise and economies expected to slow, that 2023 will be another challenging one for most advisers and investors, although there is a lot of speculation over exactly how challenging. We look at some of the sectors, asset classes and strategies best placed to emerge with earnings intact in the year ahead.

Options trading: Grab uncertainty by the collar

More experienced investors and advisers can use options and, in particular, collar strategies to provide cost-neutral downside protection in times of market uncertainty.

How long can electric vehicle transition keep driving ASX Lithium stocks?

Despite an already rapid rise, lithium prices and stock values look set to continue to strengthen in the face of worries about a weaker economic outlook, due largely to the sharp growth expected in electric vehicle demand.

Improving returns through smarter trading

Stockbrokers, smaller institutions, financial advice groups, family offices and other wholesale investors can improve efficiency, and even returns, by the way they trade their stock market investments.

There's more to ETF investing than selecting funds: don't forget about the execution strategy

In the rapidly expanding ETF market, the quoted management fee isn’t the only price you can pay.

Listed real estate sell off sparks increasing interest from investors

Australian’s love property, but when it comes to listed property, there has been little to love lately. The recent market downturn and tougher macroeconomic environment hit the AREIT market hard this year, but there are signs that may be turning around.

Elevated food prices set to drive sector growth and diversification opportunity

The Australian agriculture sector is looking forward to bumper crops at a time of rising global prices and offering an enticing opportunity for investors looking for growth opportunities and diversification. Even though short-term risks remain, structural changes mean the opportunities may be around for the longer term.

Inflation, rate rises and the rotation to value: Where are we now?

Until early this year, equity markets were resilient in the face of the rate hikes, but they are now coming around to a view in the bond markets that tighter monetary policy to tame inflation will be here longer, helping mark our position in the latest value rotation.

Smarter strategies needed to invest the energy crisis challenge

The Federal government has released its first offshore petroleum exploration permits, ensuring growth in the oil and gas sector at a time when it is seeking to boost its climate change credentials. The government’s divergent approach is symptomatic of a dilemma facing investors in the energy market – which way to play the energy crisis.

Passive defensives set to shine as uncertainty clouds outlook

The Reserve Bank of Australia is on a charge to get inflation under control, and equity markets are fearful of the economic impact. Fortunately for investors with a preference for exchange traded funds (ETFs) there are a number of products tied to defensive sectors to consider.

Tough times call for quality stocks, but finding them is harder than it looks

The sell-off in equity markets this year has many investors naturally looking for a defensive strategy. One such option is to shift into quality companies to ride out the turmoil. It sounds simple, but quality is in the eye of the beholder.

Margins, outlook statements the key to 2022 profit season

High commodity prices and a post-COVID bounce in employment and spending will drive results for 2022, but rates and inflation pose threats into next year.

ESG Risk: Navigating green claims and credentials

ESG claims are under increased scrutiny and investors and advisers need to take care.

Increased interest in private credit as inflation takes off but be cautious

As rising inflation and interest rates bring an end to the ‘everything boom’, private credit funds may offer capital protection and higher yields for investors.

Major banks on track for profit growth but challenges ahead

Interest rate hikes, a cooling economy and technology disruption are all set to hit the Australian banks this year. While the major players have all just reported positive results, the challenges keep growing so are the big 4 banks worthy of consideration?

Sharply rising inflation puts focus on hedging strategies

Inflation is firmly on the rise and looks set to remain high for longer than most investors have experienced in recent memory. We look at how to prepare portfolios for the new world.

Advised SMSF Clients Drive New Accounts, Trading Activity

Self-managed super funds guided by advisers have re-emerged as a distinct force in the Australian market since the pandemic, driving growth in account numbers, overtaking self-directed SMSFs by new account openings and showing more engagement in their trading than non-advised SMSFs, according to new AUSIEX data.

Commodities surge set to outlast supply disruptions as ESG pressures build

Recent geopolitical uncertainty has helped strengthen mining, energy and commodity stocks already enjoying a post-covid surge but the sudden boom may prove longer-lasting than many expect as decarbonisation pressures grow.

Post-pandemic boost to the digital healthcare sector

The pandemic has sped up the digital transformation of the economy, boosting the scale of data being produced while leading to a surge in the focus on healthcare, creating new opportunities in digital healthcare providers.

Post-pandemic, A-REITS faces challenges and new opportunities

Australia’s real estate investment trusts have weathered a volatile time since the pandemic storm hit but the asset has proved its resilience and new opportunities are emerging.

Cybersecurity: growing threats to business, opportunities for investors

The government is moving rapidly to help businesses face the escalating threat but the rising demand for protection services is also an opportunity for a growing number of listed companies.

Growth vs value in an inflationary world

A slowdown in the rapid rise in stock markets and speculation over the outlook for rate rises has revived the growth versus value debate but is the choice clear cut?

Women taking more control of their finances and trading through SMSFs

One message of International Women's Day is about female empowerment, especially regarding personal finance. AUSIEX data shows SMSFs are proving to be the vehicle of choice for younger women to take control of their financial future and invest their retirement savings.

Australian shares to earn their keep as economy returns to normal

Whilst it appeared valuations had become somewhat stretched, the “January Sales” followed by subsequent volatility have restored some value to the market at a time when there are good reasons to believe companies can continue to turn out earnings growth and justify higher share prices.

The Metaverse may be the future but the opportunities are now

The Metaverse might still sound like science fiction but companies are building it now, and the investment opportunities are being seized on.

How To Build An Alternative Income Portfolio In Volatile Markets

For income-focused investors, the listed market continues to deliver a growing range of options that combine steady, and even growing, income as interest rates rise, with the liquidity of shares.

Younger investors to the fore as fin-tech and climate-tech spur trading on AUSIEX

Surging interest in financial technology and climate themes helped shape trading in the heavyweight mining and financial services industries over 2021 as younger investors flocked to the market.

Factoring in smart beta to combat volatility

Investors have plenty of options to manage market volatility but diversification remains the key.

How inflation affects retail stocks

Inflation is re-emerging and may have major implications for financial markets. MST Marquee Senior Analyst Craig Woolford says it may be beneficial for listed retailers, but investors should tread carefully.

Diversifying with alternatives: How retail investors access private equity

Private equity is playing an increasingly mainstream role in financial markets as investors look for diversification away from highly priced public markets. As demand grows retail investors are likely to see more opportunities to participate in a market that has previously been closed to them.

Home and away: Investing in climate change

Now that Australia has set a 2050 target for net zero emissions, the race is officially on to find industries, technologies and investments that can help get us there. The challenge for investors is whether to back portfolios of international pure-play exposures, or invest in local companies that are changing the way they do business.

SMSFs increasingly for the Ys and the Zs

Out of sight, out of mind – that was a common description of superannuation in the past. However, AUSIEX trading data is now painting a different picture.

Crypto ETFs are coming

Two of the hottest investment markets – Exchange Traded Funds (ETFs) and cryptocurrencies – have rapidly come together amid clamor for liquid, transparent and fair vehicles that allow retail investors to access digital assets.

The rise of active ETFs challenges Listed Investment Companies and Trusts

A spate of new listings and fund conversions have sparked predictions that active Exchange Traded Funds (ETFs) will soon overtake the older listed investment company (LIC) sector as the preferred channel for diversified equity and debt investments.

Dive into technology ETFs

In August, investment manager VanEck forecast that the acceleration of flows into thematic exchange traded funds (ETFs) would see funds under management (FUM) reach $10 billion by the year's end. With the launch of ETF Securities’ new Semiconductor ETF on the ASX recently, the strong investor interest in capturing price growth in the technology sector through ETFs continues to accelerate.

Get ready for the new design and distribution obligation regime

New financial products' legislation puts the customer at the centre of design and distribution considerations, but the obligations fall on issuers and distributors.

Finding value in frothy markets

There are some opportunities for investors across a number of sectors despite a fully priced Australian share market.

Why the markets are hitting new highs, even as the economy falters

Australia’s economy powered out of the 2020 lockdowns to record three quarters of strong GDP growth through to the first quarter of this year. With June 2021 quarter data on Wednesday, can that momentum continue or did the end of Job Keeper wage subsidy and weak consumer data herald a slide to a double-dip recession?

BetaShares economist David Bassanese shares his view on what the data will tell us and how markets are preparing for it.

Active fund managers embrace ETFs

Active fund managers are increasingly moving into the exchange traded fund (ETF) space, creating more choice for investors.

How to protect your business and clients from phishing scams

Phishing scams are on the rise as remote working becomes the norm, but there are a number of workable strategies advisers can adopt to protect their business and clients from the threat of these fake offers.

How to choose a thematic ETF

From cloud computing to climate change, thematic ETFs have been among the big winners of the pandemic, with money pouring into the sector and a raft of new funds being launched. But how should investors choose from the growing array of options of offer?

Achieving better client onboarding

A seamless onboarding process is critical in driving a positive first impression and delighting a customer through the first engagement.

Will the momentum continue? – Themes to watch for this reporting season

The February reporting season was the strongest in 20 years, underpinned by record earnings upgrades. But can the momentum continue? With August earnings approaching, Morningstar Head of Equity Research Peter Warnes says the news is likely to be mixed this time around and provides some tips on what to look out for to ride the global recovery.

ETF take-up surges during pandemic

Take-up of exchange traded funds (ETFs) is growing strongly as advisers seek efficient and timely ways to diversify portfolios and invest thematically in a rapidly evolving market.

The rise of the younger self-directed investor

A new generation of younger, self-directed investors has flocked to the stock market during COVID, creating opportunities and responsibilities for the industry.

Women take the lead in trading

New data from AUSIEX reveals that women are closing the gap on men when it comes to investing, representing an emerging opportunity for advisers.

Positioning your portfolio for inflation

Investors will need to start thinking about how to position their portfolio for rising inflation with expected economic growth in the wake of large-scale fiscal support and stimulatory money policy.

Inside the SPAC hype: What investors need to know

Markets across the world are experiencing a boom in SPACs - a Special Purpose Acquisition Company. Branded as blank-cheque companies, the overseas enthusiasm for these companies remains robust in 2021, and while there are no signs that Australia is about to embrace blank-cheque companies, there are some cautionary lessons for local investors investing offshore.

Lessons from 1937: Will US stocks rally from here?

International growth is expected go from strength to strength over the next 12 months and while the US economy is expected to benefit, it’s worth asking the question: has the market already priced in a lot of the US economy’s recent gains and can such growth sustain its market rally?

Investor implications from the "pandemic" budget

Big spending initiatives in the 2021 Federal Budget aim to drive economic growth. With the risk of inflation low, investors can expect a positive outlook for asset markets.

Banking on dividends

There is some good news for income-seeking investors with possible buybacks in the pipeline as the big banks reported a lift in dividend payments in the May reporting season.

Three tips for dividend investing as payouts rebound from COVID lows

Dividend payments are on the rise again as the economy reboots, but not all companies are recovering from the pandemic at the same pace. Stephen Bruce, Senior Portfolio Manager at Perennial Value Management, provides some tips for investing in the post COVID environment.

Industry response to climate change nears tipping point

The global economy is being impacted by several long-term trends that are disrupting business and remoulding markets. In a series of articles, we will update you on the impact these megatrends are having on investors and the asset management industry. The first megatrend we will explore is climate change and the need for rapid decarbonisation to prevent catastrophic impacts.

Head in the clouds

Thanks to COVID-19 and the quick thinking of savvy investors, the age-old adage that to have ones’ ‘head in the clouds’ is an insult might be about to change.

How to handle constructive feedback

Feedback or criticism from a colleague or client, can come as a bit of a shock, even if it is well intended. Here’s how a behavioural finance expert recommends coping with such feedback.

Record economic rebound

National Accounts

Who inherits your super?

Clients often assume their superannuation will be paid in accordance with their will. However, this is not necessarily the case and a conversation around estate planning is key.

Biggest lift in spending in 12 years

Retail trade | Statement on Monetary Policy

Planning tips for a happier retirement

Retirement is about more than just money, investments and never having to work again. Amongst other things it’s about having more time for the things you enjoy, while at the same time finding a new purpose.

Tailoring advice for different client personalities

When offering financial advice to clients it’s important to understand their unique personalities and behaviours.

Year in Review. Year in Preview

2020 recap and 2021 outlook

The Big Issues of 2021

COVID-19 | The Biden era | Monetary policy | China | Climate change | Economic inequality | Employment | Migration.

Why the ETF trend is not always your clients' friend

ETFs are popular with advisers and their clients as they are cheap to buy into and require little administration. However, volatile markets and sector concentration bring their own risks.

What's next for the Australian, Asian and global economies?

Like many other economies, Australia has benefited from decades of global trade and investment, which the arrival of COVID-19 has severely curtailed. We examine the predictions of leading analysts.

Millennial investors see opportunity in 2020 disruption, despite risks

Online brokers are seeing record numbers of account openings despite market volatility. Financial advisers are well placed to assist new investors.

Australia in recession: the key factors affecting our economic recovery

All eyes will be on the RBA in November and December as it ponders a potentially significant rate cut. But there are other factors to consider in the face of a very uneven recession.

Demand for financial advice is soaring during COVID-19

The pandemic and lockdowns have increased collaboration between advisers and clients, including the demand for financial advice.

What US exposure means for investors

Australian investors who bet on the US tech mega-caps to outperform through the COVID-19 pandemic have been handsomely rewarded. However, the way forward is less certain.

The role of super funds during COVID-19

Access to their super has assisted many Australians during the COVID-19 pandemic. But these savings will also need to underpin the recovery as we navigate out of economic crisis.

Bridging the generation gap in financial advice

COVID-19 has accelerated a generational shift to digital offerings and this – along with the cost of financial advice – represents the biggest challenge to winning over savvy consumers.

Why professional development means building resilience

Resilience training is set to become a key part of professional development, equipping advisers with the ability to learn new skills quickly and own their careers.

Positioning Australia as an international financial services hub

While highly regarded for its robust funds management industry, Australia must review its tax regime and cut red tape if it wants to attract global fund managers and regional investors.

The importance of regularly revisiting risk with clients

Determining a client’s risk tolerance is a crucial part of generating a risk profile. But this must be balanced against an acceptable level of risk for a return on their investments.

The economics of COVID-19

Weekly Petrol Prices | Business Indicators | Credit | Inflation gauge | China data

Netflix, Fitbits and 'Big Tech': the future of financial advice

By 2030 the majority of financial advisers will offer goal-based advice spanning investment, protection, education, retirement and broader wellness, according to an influential report

Why Australians are reconsidering their insurance options

The COVID-19 pandemic has Australians experiencing a heightened awareness of their health and well-being. This makes it a good time to reassess their insurance needs.

The next normal: workplace flexibility in the post-pandemic age

As Australian companies shift their view of work from home as a stop-gap to something more permanent, one expert explains why trust and communication are the key ingredients.

Portfolio construction in uncertain times

Portfolio review and asset allocation are critical during heightened market volatility. And there are lessons to be learnt from how fund managers handle similar challenges.

Tax deductible financial advice: here's what you can claim

One of the biggest challenges is working out which financial advice fees are tax deductible. Here we break down the relevant principles.

ASIC and COVID-19: regulator updates priorities for 2020

ASIC wants financial advisers to meet both the challenges of COVID-19 and the needs of their clients. Here’s what the regulator is focusing on.

Practical fintech strategies: what you need to know

The FPA believes the advice industry now sees technology as a partner in enhancing the outcomes a client receives from working with a professional financial planner.

How to structure a professional year

New entrants to the financial advice industry will have their first 12 months mapped out by FASEA rules designed to ensure relevant skills are learned under close supervision.

Helping clients deal with financial stress

Supporting clients in the face of the COVID-19 pandemic is no easy task. But supporting them properly can mean addressing both emotional and financial stress.

Can insurance tech improve client experience?

The digitisation of advice is often cited as one of the biggest challenges facing advisers today. But technology could have a profound effect on how insurance is sold.

Helping your clients with financial decisions during market volatility

During times of crisis, it is important for financial advisers to be a voice of reason. As one expert notes, it is sometimes hardest getting clients to do nothing.

Trading in volatile times

Times of volatility may call for revised trading strategies. This piece looks at areas where advisers can improve, especially when placing large trades in the marketplace.

Adapting to FASEA's Code of Ethics

FASEA’s Code of Ethics now applies to all financial advisers. Here’s what you need to know about adapting to the current regulatory guidance.

Succession planning: how best to pass the baton

Business owners should have a succession strategy in place but effective transitions for advice practice principals are being complicated by several factors including COVID-19.

Barriers to investment: a female perspective

Financial inequality remains a reality for many women who earn less than men or who take time out of the workforce. An adviser who specialises in female clients offers her view.

How to become a truly great collaborator

Working openly with others in a sharing culture to achieve better outcomes for the business has never been easier. Here are six actions to unlock the power of collaboration.

Beyond COVID-19: key metrics and sectors to watch over 2020

CommSec Senior Economist Ryan Felsman considers how the recovery from COVID-19 will play out and picks the sectors most likely to thrive and flounder.

10 tips for working from home

Financial advisers working remotely for long periods will need to be informed, prepared and resilient. An expert offers advice on dealing with this unprecedented disruption.

Economic update: What advisers need to know

In periods of market volatility it is vital that advisers keep clients focused on their plan. It is also a chance to reinforce why financial advice is integral to meeting long-term goals.

Change can start with the individual

A great company culture can produce both an engaged workforce and a healthy bottom line. But everyone from the office assistant to the managing director needs to be involved.

The sharing economy: will disrupted incumbents bounce back in 2020?

The sharing economy will continue to disrupt established businesses but CommSec Chief Equities Economist Craig James warns that incumbents are increasingly finding ways to fight back.

Cybersecurity: What you need to know

An expert analyses the three key trends he says will drive the evolution of cybersecurity in Australian financial services over the next 12 months.

Is an SMSF right for your client?

SMSFs take time to do well – but of course so do many other things in the average client’s life. An expert suggests financial advisers draw on past experience to ensure clients are aware of potential complexities.

How video adds another level of service

Video can be a used as a powerful tool when face to face meetings are no longer an option. They can be used to introduce the adviser to new audiences, and to explain complicated concepts to their clients.

Investing when the market is volatile

Economic backdrop: Market volatility at record highs; what should investors look at in a volatile market; and keeping an eye on your portfolio

How to take feedback well

Criticism from a colleague or client, even if it is well intended, can come as a bit of a shock. Here’s how a behavioural finance expert suggests dealing with feedback.

New FASEA guidelines to explain the Code of Ethics

In response to the new Code of Ethics for financial advisers, FASEA has issued guidelines to help advisers understand the requirements.

Where to be visible on social media

The proliferation of social media platforms means there are more options than you likely have time. Here’s how to determine where to best focus your efforts.

8 tips for clients visiting financial advisers

How do you get the most out of your meetings with an adviser? Here are eight great tips for getting the most out of your time together.

How to use social media to boost your digital brand

Do you really need an advertising budget or can you use social media to grow your digital brand and your business?

Neuro-leadership: the science of better leadership

Here’s how to use neuroscience and the working of the brain to understand how you can lead yourself and others much more effectively.

More effective meetings in less time

Meetings are a necessary part of doing business but they can also eat into your day. How do you get more out of your meetings in less time while enhancing collaboration?

A snapshot into FASEA exams, courses and costs

Financial advisers are under pressure to comply with new education requirements. But it may not be as overwhelming as you think.

How to start a podcast

Here we explore the tools and technical abilities you will need to set up your own podcast and how to come up with great content.

Is it time to start listening to your gut?

Your intuition may be the answer to guiding your business decisions.

How to structure feedback to boost staff morale

The way advisers communicate is just as important as what they say. Here’s how incorporating good communication practices into the workplace will improve its culture.

Providing affordable advice to lower balance clients

Clients with different financial needs still need advice. So what is the best way to provide it when they’re struggling to make ends meet?

Single Touch Payroll is here

Employees are covered when it comes to superannuation with the ATO’s matching initiative.

Creating great client chemistry, right from the start.

Chemistry isn’t limited to science - having rapport with your client is key to boosting your business.

Are you unproductive or simply overloaded? Four ways to boost your output

While you might think it’s the lazy itch getting to you, it turns out having too much work can make you shut off. Here’s how to balance that.

Step by step: basics for advising blended families

Joint families may come with some financial baggage. Encouraging disclosure of their history is a great way to give them a healthy financial start.

How to build resilience to boost well-being

76% of workers struggle with their well-being. Knowing how to take care of your health will not just benefit you, but your company too.

Five ways your firm can fight back against cyber risks

Taking action now to safeguard your business against attacks can save you time, money and your reputation.

How to get client leads from video marketing

Understanding how to attract clients through video will help your business bloom

Raising practice performance: are the tools closer than you think?

Understanding social styles and being a versatile communicator can improve your business performance.

Chasing prospective clients: when not to sign them up

Can you tell whether a potential new client is the right fit for your business?

Dispute resolution: ASIC trains its spotlight on social media

ASIC is inviting submissions on whether internal dispute resolution schemes should proactively address complaints made on a firm’s social media platform.

Dealing with clients in personal and financial distress

Remaining focussed on the financial fallout is the best way to walk the fine line between adviser and mentor.

Your financial advice practice needs strong foundations

Amidst financial and practical decisions to make, a strong financial practise needs to meet these certain criteria to create a strong foundation.

Dealing with setbacks: four ways to build resilience

No matter how skilled you are, when not everything is in your control, things can sometimes go wrong. Here’s how to work through these roadblocks.

How to engage employees on your innovation journey

Staff training underpins innovative organisations. But not just any training. Commonwealth Bank’s latest Business Insights report analyses which programs work best.

Making flexible work realistic for financial advice practices

Three ways to make flexible working arrangements realistic for financial advice practices.

9 things you may not know about the FASEA blueprint

FASEA announced a revised education framework in late-2018 with some welcome modifications. Here’s what financial advisers may not know about the blueprint.

Investing in Thematic ETFs now needs Active Management

Thematic ETFs have boomed during the dramatic equity market recovery that has followed the Covid-19 shock, dubbed ”the everything rally”. Going forward, investors will need to be more selective and ensure their thematic ETFs are based on solid, confirmed megatrends that have a probability of play out over the long term.

Green is good, say Australian traders

Trading volume in ESG-related stocks has increased considerably since 2019 and Australian investors are diving into new ‘green’ sectors.