SMSF funds look to financial advisers to navigate market turbulence

New self-managed superannuation fund investors looked more closely to financial advisers for guidance last year as the bull market hubris of COVID lockdowns subsided amid more challenging market conditions.

New research from AUSIEX shows a more than 30% decline in the number of new SMSFs established by self-directed clients in 2022, versus a decline of just 9.2% in new accounts established by investors under the auspices of a financial adviser.

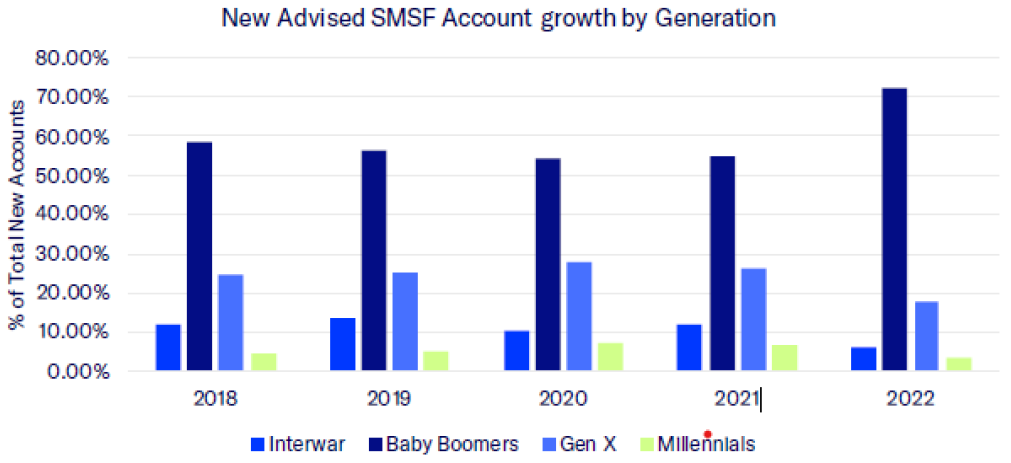

The sharp fall in new self-directed accounts was led by a more than 30% slump in first-time Millennial SMSF investors as the appeal of managing a nest egg was perhaps dulled by a recognition of the commitment required to operate a successful fund. Millennials also accounted for the biggest fall in new advised SMSF accounts at AUISEX (9.3%).

Overall SMSF account numbers remained steady over the year and emerging patterns in investor behaviour point to opportunities for advisers to attract clients by offering guidance related to investment strategy, diversification and administration.

For example, the proportion of females who opt to open SMSFs as a primary account holder continues to rise, accounting for more than a quarter (26.3%) of all new advised funds in 2022. The growing enthusiasm among this cohort, particularly amongst those in their mid-40s and above, may represent acquisition opportunities for advisers.

Interestingly, Victoria was a hotspot for new SMSFs last year and recorded a 21.2% jump in the proportion of new advised accounts created by AUSIEX clients. By contrast, new advised accounts in New South Wales actually fell by 26.8%. Most other states and territories experienced only modest declines.

The proportion of new Advised SMSF accounts administered for Gen X and Millennials has fallen from 2020 highs (Source: AUSIEX February 2023).

Where SMSFs invest

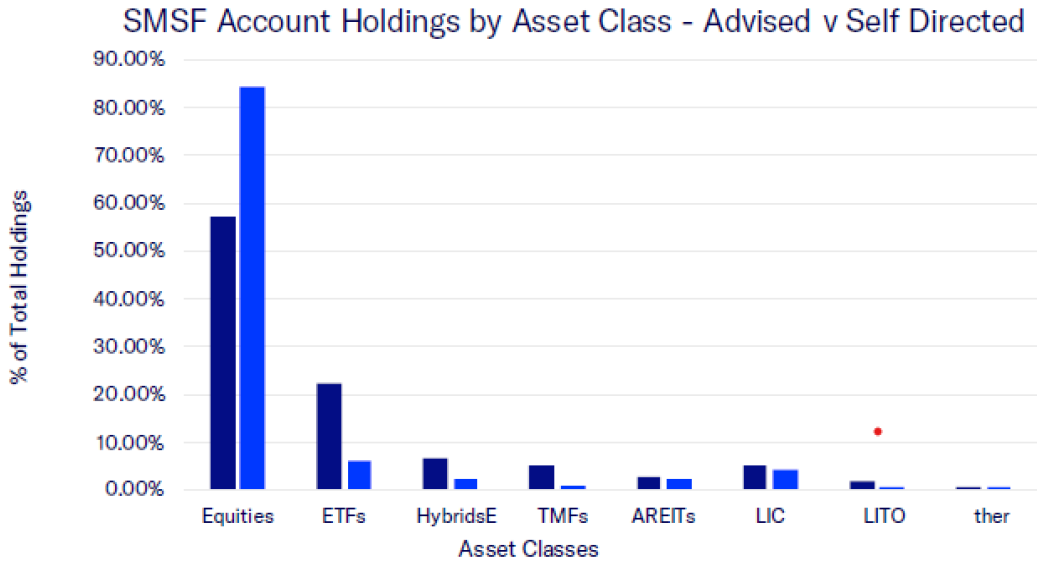

In February this year there was a marked difference in the asset allocation of advised and self-directed SMSFs, suggesting advised investors were in a better position to withstand the volatile trading conditions that became a hallmark of 2022.

Indeed, advised AUSIEX clients had just under 60% of their holdings in ordinary shares in February, compared to a more aggressive asset allocation of 87.41% among self-directed SMSF investors.

Advised clients also showed greater interest in ETFs by allocating 22.23% of their portfolios to this class, versus only 5.95% for self-directed SMSFs.

Hybrid securities ticked up to 4.33% of total traded value among advised clients in 2022 and expectations of a better year for bonds were likely behind the notable preference that many displayed for fixed interest ETFs.

Unsurprisingly, most AUSIEX clients are heavily invested in the financial and materials sectors which dominate the Australian sharemarket – but SMSF clients with an adviser also had a greater inclination to spread their capital across other sectors by taking overweight positions in healthcare stocks (12.24% of holdings) and consumer staples (8.23% of holdings).

Advised SMSFs are more diversified across asset classes in comparison with their self-directed counterparts (Source Data: AUSIEX February 2023).

Where to next?

Market conditions are likely to remain volatile for the foreseeable future as economic pressures and geopolitical uncertainty combine to cloud the outlook for investors. In this environment, trustees may be more likely to seek professional advice to help manage risk by diversifying their retirement savings into assets previously not on their radars.

With balances that are on average four times larger than non-SMSF clients, trustees who seek advice continue to provide a significant business opportunity for planners who can provide quality service to this segment of the market.