Little relief in sight for Australian bank shares

Australia’s major banks reported first-half earnings in line with expectations, but professional investors are unconvinced the recent share price underperformance of the big four will be reversed in the short term.

The majors delivered collective cash profits after tax of $17 billion in their first halves, a 16.6% increase on previous corresponding periods, according to KPMG1.

Despite the relatively good news, headwinds confronting the sector are weighing on investor sentiment. A potential deterioration in asset quality, impact of the US banking crisis and economic uncertainty are behind a cautious tone from analysts.

AUSIEX asked three experts to distil the earnings announcements and provide their take on the outlook for the big four in the months ahead.

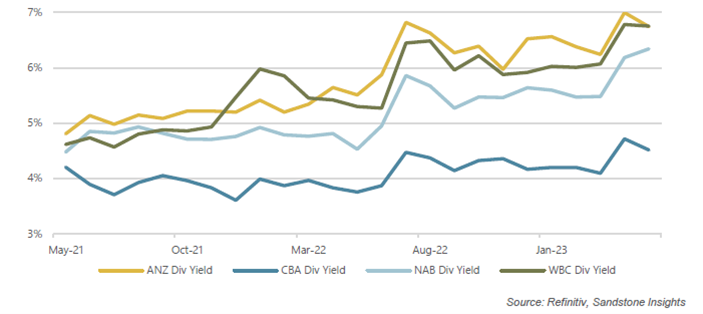

MST FinancialJohn Lockton, Head of Investment StrategyTop take-outs Overall, the major banks all delivered a strong set of earnings. Dividends were either in line with or fractionally above expectations. Bank capital positions remain very strong, as do credit provisions. We estimate that National Australia Bank (ASX: NAB), Westpac (ASX: WBC) and ANZ (ASX: ANZ) have 3% to 6% of their market capitalisation in surplus capital, putting each of them in a strong position to return capital to shareholders via on-market share buybacks. The fourth quarter of 2023 is the most likely timing for buybacks but NAB could make an announcement as soon as its third quarter results in early August. MST Financial retained a “buy” recommendation on Westpac following its earnings announcement and has “hold” recommendations on each of the remaining big four. Looking ahead Net interest margins (NIMs) dominated discussion that followed each announcement. Consensus forecasts have removed any benefit of higher interest rates on margins from FY2024 earnings and there were downgrades across the street of approximately 5% for FY2023 earnings. Overall, the negative earnings momentum evident across the sector has continued past first half results. Valuations are beginning to show some appeal, with dividend yields of more than 6.5% and the prospect of capital management initiatives in late 2023. Nonetheless, the uncertainty created by the US banking crisis and share price under-performance of US banks are both weighing on market sentiment. We do see Aussie banks as significantly differentiated to their US peers. But, in the short term at least, there is a lack of positive catalysts to turn around the sector’s recent share price performance. Bank dividend yields move above 6%

|

|

Infinity Asset ManagementDom Mlcek, Portfolio ManagerTop take-outs Interim results from major banks were reasonably solid, with double digit growth in profits versus this time last year as the sector cashed in on the rising rate environment. However, the results were largely in line with expectations and provided little in terms of upside surprises. Two key themes stood out. Firstly, higher operating costs continue to impact the industry. Secondly, intense competition in mortgage lending, cost each of the big four anywhere from 7-12 basis points in net interest margins (NIMs) during the reporting period. This ongoing competition, which has now also crept into deposits, remains a headwind and we expect NIMs to deteriorate in the second half. The results highlighted that the benefit from official rate rises was relatively short-lived and peaked earlier than expected during the first quarter, with exit NIMs much softer than anticipated at the end of March. Looking ahead Banks face a challenging environment going forward, despite being well capitalised with CET1 ratios providing flexibility and capacity for future capital management initiatives. Earnings growth is likely to slow before turning negative in FY2024 as bond yields normalise (potentially moving lower) and credit growth softens. Additionally, as tens of billions of dollars roll over from fixed rate mortgages, banks will have to focus on retention versus growth. At the same time provisions for loan losses will continue to rise, albeit off a current low base. Despite the recent underperformance from the banks, valuations don’t look attractive when comparing price to book metrics, to the return on equity that’s offered. As a result, we’ve retained our large underweight position towards banks across our Australian equity portfolios. |

|

Equity Trustees Asset ManagementChris Haynes, Head of Australian EquitiesTop take-outs The banks all reported very solid first half earnings; profits rose, dividends increased and excess capital was generated. Bad debts were nowhere to be seen, net interest margins expanded, costs were under control and there were no regulatory issues of note. These were a good set of numbers across the majors. The only real negative was that the stock prices of banks declined, in an indication of a change in expectations. Looking ahead Looking out, it seems most of the positives we’ve just experienced, will reverse and become headwinds instead. There was hardly any sign of distress in any of the lending books after all the rate rises of the past year, but we know from here things are going to get worse; bad debts will rise. It is difficult to be bullish given we have little line of sight on bad debts yet. Will it be a soft or hard landing? Things could get quite a bit worse, so it makes sense to be cautious. We do know for certain that the purple patch of rising margins has now finished. Margins are in decline. There is deposit competition and mortgage competition at the same time. Cost pressures seem to be more under control, but margins and bad debts will make things difficult. The banks are well prepared for this next downcycle with strong balance sheets and solid provisions, so we don’t want to be too negative. It is just another cycle and the banks, excluding Commonwealth Bank (ASX: CBA), are cheap, but I think they may become cheaper. |

.png) |

1 https://kpmg.com/au/en/home/insights/2023/05/major-australian-banks-half-year-results-2023.html