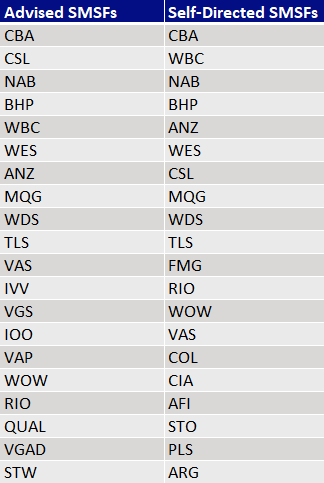

Which stocks are popular with SMSF investors?

Regular reviews of share portfolios by financial planners is a potential driver of key differences between the top holdings of advised and unadvised self-managed superannuation fund (SMSF) investors.

Unsurprisingly, the very largest listed companies dominate the overall holdings of SMSF portfolios which use AUSIEX for trading shares. Traditional blue-chips such as the major banks, BHP Group (ASX: BHP), Woolworths (ASX: WOW) and Telstra Group (ASX: TLS) are as much a mainstay of SMSFs as any managed fund.

But SMSFs under the guidance of advisers also have notable assets in the health sector, with Ramsay Healthcare (ASX: RHC), Resmed (ASX: RMD) and Sonic Healthcare (ASX: SHL) featuring in the overall top 30 holdings of those investors alongside industry heavyweight CSL (ASX: CSL). By contrast, CSL is the only health company in the top holdings of non-advised clients.

“The largest blue-chip companies have remained largely the same over the past decade but the sector composition of the ASX has changed significantly. This shift has likely caused a large divergence in portfolio positions between people who adopt a passive buy and hold approach versus those who take a more active approach with the guidance of an adviser,” said Dominic Mlcek, Portfolio Manager at Infinity Asset Management.

“The healthcare sector, for example, has more than doubled its representation within the top 50 ASX names over the past 10 years. It has gone from the ninth largest sector in 2013 – at circa 4% of the market – to the third largest sector today at more than 10%,” Mlcek said.

“Regular review and active management of portfolios will have likely captured a large part of this shift and resulted in increased exposure to health care companies. These stocks have typically delivered higher than market earnings growth and are expected to continue to do so over FY24.”

Beyond health

Unadvised funds have a greater preference for resources and energy stocks than advised peers, with Woodside Energy Group (ASX: WDS), BHP Group (ASX: BHP), Fortescue Metals Group (ASX: FMG), Rio Tinto (ASX: RIO), Santos (ASX: STO) and AGL (ASX: AGL) all featuring in the top 20 holdings traded via AUSIEX for this category of investor.

Mlcek suggested the rise of lithium and gold together with the strength of other resource related businesses has provided additional diversification opportunities for those actively managing their resources exposures within equity portfolios.

BHP, Woodside and Rio Tinto, though, are the only resource companies in the top holdings of advised portfolios.

Mlcek is also of the view that actively managing share exposures is important to ensure portfolios have an appropriate level of risk at any given point in the investment cycle, especially given the dynamic nature of investment markets.

The biggest holding across all AUSIEX SMSF portfolios is Commonwealth Bank of Australia (ASX: CBA), Westpac (ASX: WBC), NAB (ASX: NAB) followed by BHP Group (ASX: BHP), ANZ (ASX: ANZ), CSL (ASX: CSL), Wesfarmers (ASX: WES) and Macquarie Group (ASX: MQG).“To help make way for the healthcare stocks – and to a lesser extent IT companies – it’s probable actively managed [SMSF] portfolios have concentrated their blue-chip resource exposures into the largest and most diverse names,” Mlcek said.

Non-advised portfolios have an additional bank in their top holdings in Bank of Queensland (ASX: BOQ), despite its volatile share price.

Other stocks which are exclusive to the top holdings of advised portfolios, including Transurban (ASX: TCL) and Vanguard’s Australian Property Securities Index ETF (ASX: VAP) – with the latter actually ranking above big companies such as Rio Tinto (ASX: RIO).

Figure 1: Top 20 SMSF Security Holdings

Read our 2024 whitepaper of the profile and trading behaviours of advised SMSF clients.