Positioning your portfolio for inflation

Investors will need to start thinking about how to position their portfolio for rising inflation with expected economic growth in the wake of large-scale fiscal support and stimulatory money policy.

In 2020, the global pandemic drove central banks and governments worldwide to unleash unprecedented monetary easing and fiscal stimulus packages. This spurred record low-interest rates and massive government debt. The cash rate in Australia now stands at 0.10%, while Federal Government debt is edging towards the $966.2 billion mark.

According to Janus Henderson Investors Head of Australian Fixed Interest Jay Sivapalan, society was comfortable giving central banks and governments this "liberal licence" so they could effectively respond to the once-in-a-lifetime event by supporting jobs and driving growth.

The focus on controlling inflation was eclipsed by the immediate need to focus on creating jobs and sustaining industries amid large scale lockdowns. However, once unemployment rates trend downwards – the latest employment figures in Australia have fallen by 0.2% to 5.5% - inflation will begin to rise, underpinned by the growth that comes with more people in jobs.

As a fixed income manager, inflation remains one of Sivapalan's considerations.

"As we get past COVID-19, we will need to start thinking about the next decade. With the high levels of debt, the focus will shift to financial stability," he says, adding that one option for governments is to "grow their way out of debt".

"We believe governments and central banks are going to attempt to run economies a little bit warmer – that is, stimulate growth - than they previously did. This will put upward pressure on prices and inflation," Sivapalan says.

Great expectations

Sivapalan expects some near-term pickup in inflation but says it is likely to be transitory and some time away until inflation rises sustainably. This view is also held by the Reserve Bank which is expecting inflation to be between 1.5% to 2.5% by 2023.

However, for VanEck Head of Investments and Capital Markets Russel Chesler, inflation growth is here, and is real. In fact, he is living the experience. Having bought a house in the middle of the year, building material prices have already risen by half a per cent from the originally agreed amounts on the tender.

It is the bottleneck in supply shortages that, in part, will be driving up inflation.

While the latest CPI was 0.6% in April and 1.1% over the quarter, the Australian Bureau of Statistics highlighted that the number of government schemes and housing grants helped keep inflation down, leading to a fall in new housing prices.

"Without the offset from these grants, the price of new housing would have risen, reflecting increases in materials and labour prices in response to strong demand," Chesler says.

For Chesler, surging commodity prices, a leading indicator of inflation, has spurred rising inflation expectations – now at the highest levels since 2008.

"We are seeing sharply high prices for iron ore, oil and other commodities as well as building materials such as timber and steel," Chesler says.

"The COVID-19 pandemic is still causing economic havoc, feeding supply shortages, bottlenecks and rising costs of important commodities and raw goods, which will inevitably feed through to inflation."

Portfolios for a post-COVID world

There are a number of strategies investors can adopt to cushion the impact of rising inflation, according to Sivapalan, and one way is to buy inflation-linked bonds.

He made an allocation to inflation-linked bonds last year when the market assumed that there would be no inflation.

Fast forward to today, and as highlighted earlier, the average inflation expected in Australia for the next decade will be about 2.1%.

"For investors, it is the pricing of inflation that matters most. It's valuable to buy inflation protection when others don't want it or don't price it in, and to sell inflation protection when market participants expect high inflation outcomes,' Sivapalan says.

"We still think it is worth having some inflation protection but have since reduced our holdings."

Risk assets such as shares will be supported in a pro-growth world as policymakers and governments keep the levers on stimulatory measures, according to Sivapalan. However, he is also thinking about a number of 'winners" emerging from a post COVID world. He sees opportunities in several sectors such as defence, health and data.

With the arrival of COVID-19, there was a recognition Australia needed to produce and locally supply medical equipment, and locally-based call centres are now crucial to ensure data security and privacy. These themes are embedded in his investment thinking, and he is eyeing opportunities to lend to such companies "where available". At the other end of the spectrum, the bond manager is looking at industries hit hard by COVID.

"We are backing a number of universities at the moment, providing them funding as cornerstone investors."

Chesler has identified several assets and sectors he believes will provide investors some protection against rising inflation, including value stocks, real estate, infrastructure and energy and utilities.

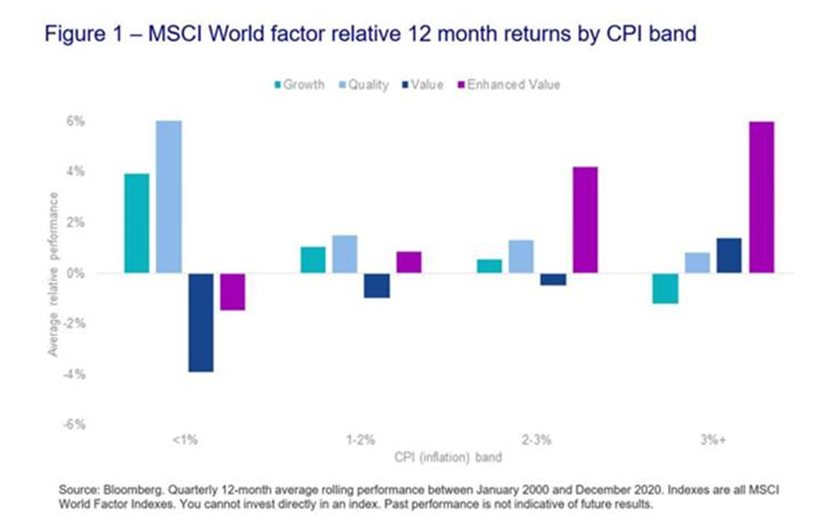

According to Chesler, value stocks are less sensitive to changes in macroeconomic conditions, as highlighted in Figure 1 below, compared with growth stocks, which tend to lead to outperformance during higher inflation periods..

Source: VanEck

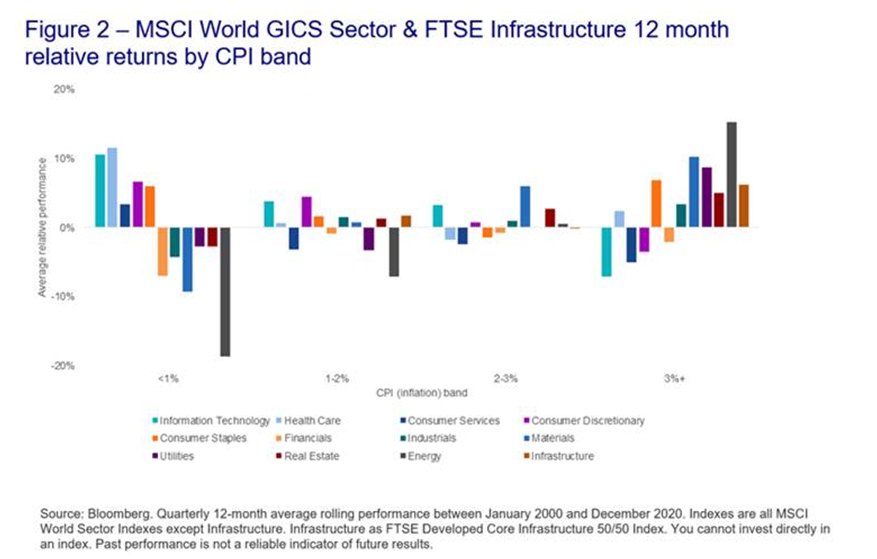

Real estate is another sector that effectively provides a hedge against inflation because property and rental income rise when inflation rises, as illustrated in Figure 2.

Source: VanEck

Similarly, Chesler says most infrastructure assets explicitly link to inflation through concession agreements, regulation, or contracts.

"For example, road tolls typically increase at maximum of CPI or a specified fixed rate," he says.

Energy and utilities are also viable options to protect investors against inflation. According to Chesler, this is because water, electricity and gas utilities are often pegged to inflation through regulated pricing.

While inflation will tick up, Chesler is not of the view that inflationary growth will trend to the significant levels that investors experienced back in the 1970s and 1980s.

"Central banks and governments have managed to control inflation. I don't think we will be going back to the levels we had when inflation rates were at 10% to 15% or even 5%," he says.