Options trading: Grab uncertainty by the collar

We’ve all got stocks in our portfolio that would be rated as a buy with significant upside potential, though we can foresee some external factors in the not-too-distant future that may act as a catalyst to change our positive outlook, or which may not eventuate at all.

Whether it’s a potential recession brought on by significant recent interest rate increases, the capitulation of demand for raw materials caused by slowing Chinese growth or energy costs rising further due to the Russia-Ukraine conflict, there will always be volatility and potential downside risks on the horizon with which investors will need to contend.

Hedging Summary

If investors are concerned with the future performance of a stock, they can hedge their exposure; buying a security with inversely correlated returns, so if the value of your stock goes down, all other things being equal, their hedge should go up.

Investors can potentially achieve this by using futures or warrants with the objective of directly offsetting a loss on a stock.

Alternatively, investors can buy a Put option to lock in a future price for the sale of the stock. Buying a Put has the added benefit of being at the buyer’s discretion, so if the stock remains above the agreed price, the Put will expire worthless with the stock holding remaining unimpacted.

An Alternative approach

Each of these strategies, however, has its own pitfall. Futures or warrants will typically provide a like-for-like hedge entirely offsetting any upside, so while you’re hedged to the downside, you’re also not going to see any upside should the stock unexpectedly rally.

With a bought Put, while you keep the upside, the cost of buying the Put can be significant over time, and dependent on how volatile the stock is, potentially cost-prohibitive in practice.

What if there was a way to use options to obtain the protection of a bought Put without the cost?

As with any option position, there’s always a trade-off. In this case, the trade-off comes from funding the purchase of the Put by selling an out of the money Call, effectively foregoing any upside beyond the strike price.

Construction

The below example uses a hypothetical energy company ZZZ Limited (ZZZ) as at 25 October 2022, 11:45AM.

Current stock price $35.40.

Assuming the investor holds 1,000 ZZZ initially bought at $35.40.

Options Trades

Buy 10 15th December 2022 Put Strike: $32.00 American (100 shares per contract) @ $0.70

Sell 10 15th December 2022 Call Strike $38.51 European (100 Shares per contract) @$0.825

In the above example, the investor has purchased a Put for $0.70, offsetting any share price fall beyond $32.00.

The purchase of the Put is funded by selling a Call for $0.825, where the investor agrees to deliver the stock if called upon at the strike price of $38.51. By writing the Call, the investor limits their potential gain as they will not receive any benefit beyond the $38.51.

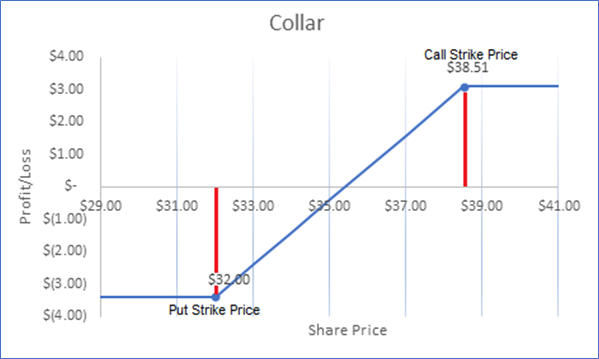

The above example allows the investor to hedge any loss beyond 9.6% ([32.00-35.40]/35.40 = 9.6%), at zero cost*, though the investor will give away upside beyond 8.8% ([38.51-35.40]/35.40=8.78%), yielding the below pay-off diagram with 3 possible outcomes when the options expire on 15 December.

Source: AUSIEX

ZZZ < $32.00

Should the price of ZZZ close at $30.00 per share on 15th December, the sold $38.51 Call would expire worthless, while the bought $32.00 Put would expire in the money and be exercised, allowing the investor to sell their ZZZ shares at $32.00. The investor receives $2.00 per share above the prevailing share price.

In this case the investor’s use of a protective collar has limited their loss to $3.40 per share (Put strike price [$32.00] - initial ZZZ price [$35.40] = -$3.40).

ZZZ between $32.00-$38.51

Should the price of ZZZ close between $32.00-$38.51 per share on 15th December, both the $32.00 Put and $38.51 Call will expire worthless with the investor retaining their ZZZ shares.

ZZZ > $38.51

Should the price of ZZZ close at $40.00 per share on 15th December, the sold $38.51 Call would expire in the money with the investor assigned and required to deliver their ZZZ shares at the strike price of $38.51. The Bought $32.00 Put in this scenario would expire worthless.

In this case, the investor’s use of a protective collar has limited their upside to $3.11 per share (Call strike price [$38.51] - initial ZZZ price [$35.40] = $3.11).

Pitfalls & Considerations

Downside hedge Vs Forgone upside

As outlined above, when employing options strategies over a portfolio its essential to understand the risk and trade-offs involved and ensure you as an investor are comfortable with them.

When employing a “cost-less” protective collar for example, it’s important you consider how much of the shares value you are looking to hedge vs what would you be willing to deliver the stock for if it performs strongly.

If you are looking to keep outlay to a minimum (all else held constant), the higher the strike for your Puts (the more conservative your approach) the more expensive they will be to purchase. This means your Calls will need to have a lower strike to offset the more costly Put hedge. The lower your Call strike price the more upside you potentially forgo should the stock outperform.

Consider Collar Width

Similarly, the smaller the distance between the strike of your Call and Put, the more likely an investor is to have either their Call or Put expire in the money, resulting is the underlying stock being sold.

To illustrate this in an extreme example, let’s assume the price of ZZZ is now $34.50, where an investor sells a December ZZZ Call at $34.51 and buys a December ZZZ Put at $34.50 to ensure no loss beyond the current share price.

In this example if the ZZZ closes on expiry date below $34.50 the Put will be exercised with the investor receiving $34.50, while if ZZZ closes above $34.51 the Call would be assigned with the investor delivering the stock receiving $34.51.

Given the transaction costs involved the investor may prefer to simply sell the stock today for $34.50. While this is an extreme example, you can appreciate the implications when deciding on how wide to set you collar.

Writing European Vs American

It’s worthwhile considering whether to use American or European style options when employing a Collar, particularly on your sold Call. Remembering that American options can be exercised at any time up until expiry, while European options can only be exercised at expiry. As it is the buyer who has the right to exercise an American style option early, as the seller of the Call (when employing a Collar), we need to consider the likelihood of the counterparty exercising the Call before expiry as this will completely change the strategy and payoff diagram akin to that of a bought Put. The example above uses a Sold European Call in order to mitigate this risk.

Summary

Options are often misunderstood, though are simply a tool that when understood, can allow us to better trade in line with our views. In this case, a “costless” collar can be deployed when the investor doesn’t wish to sell the stock immediately, and is nervous about potential downside risks coming to fruition and is seeking to hedge some of this risk in exchange for giving away some of the upside should the stock perform strongly during the life of the option.

*Please note, the above examples exclude transactions costs, such as brokerage and clearing fees.

General Advice Warning

This information contains general advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider its appropriateness, having regard to your objectives, financial situation and needs. Investors should read the relevant disclosure document and seek professional advice before making any decision based on this information. This information has been prepared by Australian Investment Exchange Limited (AUSIEX) ABN 71 076 515 930 AFSL 241400, a wholly owned subsidiary of Nomura Research Institute Limited (NRI). AUSIEX is a Market Participant of ASX Limited and Cboe Australia Pty Ltd, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.