The rise of the younger self-directed investor

A new generation of younger, self-directed investors has flocked to the stock market during COVID, creating opportunities and responsibilities for the industry.

In the last year, self-directed investing in Australia has surged as younger generations take advantage of increased time at home and more accessible trading options to learn about the stock market and start trading.

A new whitepaper from AUSIEX, Australia’s trading transformation, shows clients opened a record number of new self-directed trading accounts on institutional trading platforms powered by AUSIEX during the early months of the COVID pandemic. The average monthly account openings during March-May 2020 were 450% higher than the preceding 27 months.

Mathew Tilley, Head of Markets and Client Solutions at AUSIEX, said the pandemic provided people with more time to trade and more awareness around the markets.

“Constant news about the significant fall in the market in March 2020 and the rapid rebound took awareness of what was happening to the masses. In an environment where customers have been critical of deposit rates coming down, people were searching for an alternative,” he said.

“The volatility offered many opportunities for investors who were willing to step into the market, and they were really spoilt for choice, as we saw more organisations targeting the retail sector, including offerings that tried ‘gamifiying’ the investment world and those providers that aimed to reduce the barriers to entry with micro-investing offerings.”

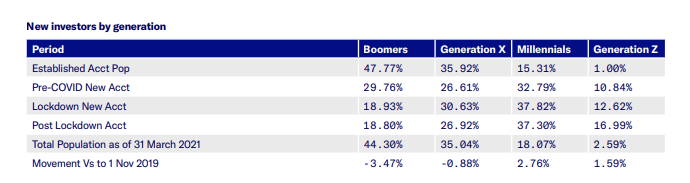

Self-directed investing by younger generations was already on the rise before the pandemic. Between November 2019 and February 2020, there was a 10-fold increase in the number of new Generation Z investors to 10%.

“Even the youngest Millennials have reached adulthood,” said Tilley. “While this generation may have been hampered by some unfavourable economic circumstances, such as diminishing household affordability, this demographic has increased disposable income and a strong values-based approach to investments.”

Tilley noted that trading is becoming more accessible and more affordable than ever, increasing the ability for younger generations to participate directly in the market.

“The expansion and acceleration of technology have been both a positive and a negative. Technology has helped to connect investors with education about trading and investing, such as social stock forums. These forums do provide education but also create fear of missing out. There is this feeling of wanting to be part of the in-group. Also, it allows people who are faced with isolation a bit of connectivity,” he said.

Between March 2020 - October 2020, when pandemic-related lockdowns heavily impacted the nation, there was another significant shift towards new younger investors with a 5% increase in new Millennial clients and a slight increase in the Generation Z segment (2%).

There was also a big swing from Generation X to Generation Z, of around 4%. A total of one in six new self-directed investors since November 2020 have been Generation Z. A year before, and they were one in 100.

Table 1: New investors by generation

Changing face of trading brings opportunities and responsibilities

The whitepaper revealed two different and varied approaches in the same environment of volatility. Self-directed investors enthusiastically jumped into opportunities, while advisers took a more strategic and long-term approach.

The findings in the paper suggest self-directed investors may have contributed to the surge in share prices of Afterpay and Zip in 2020. These investors jumped on the sector compared with advisers who resisted buy now pay later (BNPL) stocks on behalf of their clients. Advisers went from 1.7% of accounts trading BNPL to 3% of accounts trading BNPL during 2020, while self-directed investors went from 6% to 26%.

Self-directed investors were also two to three times more likely to trade travel stocks during the lockdown period than advisers trading either direct or through a platform on behalf of their clients.

In the paper, AUSIEX says the industry has a heightened responsibility to connect with self-directed clients to support their education and awareness of the investing world.

“We see that self-directed investors are trading differently to advisers on behalf of their clients, and there can be an opportunity to close the gap. By connecting this with the burgeoning market of younger investors and women and helping them understand their long-term goals, there is also a benefit and opportunity for intermediaries to grow their business base,” AUSIEX says in the report’s concluding remarks.

The Australian Securities and Investments Commission outlined concerns in their report “Retail investor trading during COVID-19 volatility” that a portion of self-directed investors have made behavioural mistakes during this period, including poor market timing and increased trading in complex and high-risk products.

Tilley said advisers and institutions providing trading to self-directed investors are aware of, and acting on, the growing need to educate new traders who may have a large amount of enthusiasm but lack the time in the market.

“We have seen an increase in support from institutions and advisers to help self-directed clients, as often a portion of these investors come to the market and don’t necessarily take a systemised approach. At AUSIEX, we use various methods to educate new traders, from face-to-face, to over the phone. So, for example, we’ve had a large number of fund managers speak to our retail clients on webinars. We recorded a 300% rise in the take up of clients signing up to webinars post-COVID.”