Active fund managers embrace ETFs

Active fund managers are increasingly moving into the exchange traded fund (ETF) space, creating more choice for investors.

Having witnessed strong growth in passive exchange traded funds (ETFs), traditional fund managers are now increasingly moving into this space by launching active ETFs.

In the first half of 2021, seven new ETF issuers joined the market in Australia, all of which were active managers, and four funds converted into active ETFs.

Active managers that launched their first ETFs this year include Hyperion Asset Management, Apostle Funds Management and Alliance Bernstein.

Industry participants says there’s plenty more where that came from.

Cboe CEO Vic Jokovic says many more fund managers are looking to launch ETFs: “We are really at the start of the journey. It’s a focus for most active fund managers at the moment. Most, if they haven’t already thought about it, are certainly thinking about it now.”

New ETFs listed since Dec 2020

|

Fund name |

Code |

AUM |

Listing Date |

Management Style |

Listing Venue |

|

Coolabah Active Composite Bond Fund |

FIXD |

$76.1M |

21/06/2021 |

Active |

CXA |

|

Monash Absolute Active Trust |

MAAT |

$31.5M |

10/06/2021 |

Active |

ASX |

|

iShares Core MSCI Australia ESG Leaders ETF |

IESG |

$10.8M |

4/06/2021 |

Passive |

ASX |

|

Magellan FuturePay |

FPAY |

$17.1M |

2/06/2021 |

Active |

CXA |

|

BetaShares Aust Major Bank Hybrid Index ETF |

BHYB |

$13.1M |

23/04/2021 |

Passive |

ASX |

|

AB Managed Volatility Equities Fund |

AMVE |

$1.52B |

6/04/2021 |

Active |

CXA |

|

Elstree Hybrid Fund |

EHF1 |

$9.7M |

31/03/2021 |

Active |

CXA |

|

360 Capital Active Value Equity Fund |

TAVF |

$295,532 |

24/03/2021 |

Active |

CXA |

|

Hyperion Global Growth Companies Fund |

HYGG |

$1.6B |

22/03/2021 |

Active |

ASX |

|

BetaShares Climate Change Innovation ETF |

ERTH |

$95.8M |

11/03/2021 |

Passive |

ASX |

|

VanEck Vectors Global Clean Energy ETF |

CLNE |

$62.7M |

10/03/2021 |

Passive |

ASX |

|

VanEck Vectors MSCI International Small Company ETF |

QSML |

$15.6M |

10/03/2021 |

Strategic Beta |

ASX |

|

VanEck Vectors International Value ETF |

VLUE |

$34.7M |

10/03/2021 |

Strategic Beta |

ASX |

|

Apostle Dundas Global Equity Fund – Class D Units |

ADEF |

$7.3M |

24/02/2021 |

Active |

ASX |

|

BetaShares Cloud Computing ETF |

CLDD |

$43.3M |

24/02/2021 |

Passive |

ASX |

|

Switzer Higher Yield Fund (Managed Fund) |

SHYF |

$25.6M |

23/12/2020 |

Active |

CXA |

|

MFG Core International Fund (Managed Fund) |

MCSG |

$14.5M |

15/12/2020 |

Active |

CXA |

|

MFG Core Infrastructure Fund (Managed Fund) |

MCSI |

$368.5M |

15/12/2020 |

Active |

CXA |

|

MFG Core ESG Fund (Managed Fund) |

MCSE |

$14.1M |

15/12/2020 |

Active |

CXA |

|

Magellan Sustainable Fund (Managed Fund) |

MSUF |

$8.0M |

15/12/2020 |

Active |

CXA |

Source: Cboe, Morningstar

The move by fund managers to offer exchange traded products is a global trend. The Financial Times recently reported that the pace of ETF launches in the US has doubled over the past two years as a wave of mutual fund managers tap the rapidly growing ETF market.

In June, Dimensional Funds converted $30 billion worth of mutual funds to ETFs, the largest conversion of its kind to date.

Innovations provide a pathway

Several innovations have cleared the way for strong growth in active ETFs in the Australian market in recent years.

The first big breakthrough came in 2015 when Magellan pioneered a new category of non-transparent active ETFs to list the Magellan Global Equities fund.

Passive ETFs are required to disclose their full portfolio every day however active fund managers have been reluctant to adopt this model given it would make it easy for others to replicate their portfolio.

Magellan worked with the Australian Securities and Investments Commission to develop a new disclosure regime for active ETFs where they are only required to disclose the portfolio details quarterly and with a two-month lag.

“Making an open-ended fund available on the stock exchange while preserving their intellectual capital has been considered the holy grail for fund managers,” said Magellan Asset Management - Key Account Manager – Listed Funds Jennifer Herbert.

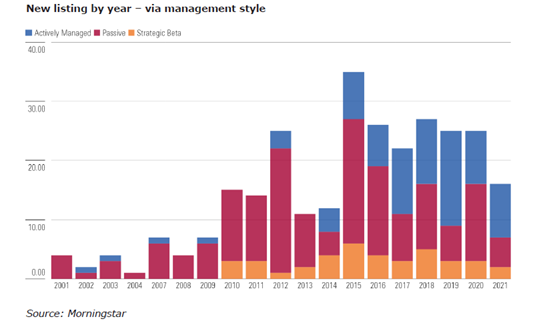

Since then, actively managed funds have made up an increasing proportion of new listings, representing more than half of new listings in the first half of 2021.

Next generation ETFs

In a further innovation, Magellan launched the Airlie Australian Share Fund with the ‘Single Unit’ structure in 2018.

This innovative structure allows investors in the fund to buy and sell units either on the exchange or directly through the fund manager, according to their choice.

Previously, fund managers wanting to access the listed market would need to create a separate listed fund. By having the one fund that can be distributed through both the listed and unlisted channels, fund managers save on costs and investors can transact either on-market or off-market with ease. Magellan now has seven funds (two on ASX and five on Cboe) that follow this structure.

Hyperion Asset Management followed in the footsteps of Magellan when it listed its first managed fund on the Australian Securities Exchange (ASX), the $1 billion Hyperion Global Growth Companies fund (HYGG), in March. Similar to Magellan’s one-unit structure, the fund gives investors the option to hold unlisted units via the responsible entity or buy the listed units on exchange. Several other funds have since been listed with this model including Switzer Higher Yield Fund (SHYF), Magellan FuturePay (FPAY) and the Coolabah Active Composite Bond Fund (FIXD), which are traded via Cboe.

“We really just think of this as the next generation of ETFs and this is fast becoming the way that funds are put together,” said Magellan’s Herbert.

A more flexible approach

Cboe Australia, which began listing ETFs around 18 months ago, has been working with fund managers to further simplify and fast track the process of creating and listing active ETFs, which it refers to as quoted managed funds (QMFs).

Cboe’s Jokovic said the exchange operator responded to demand from fund managers that wanted to offer products on an exchange but were finding the process took too long or the ASX listing rules, set up for passive ETFs, were not flexible enough to suit their actively managed funds.

“We reacted to a number of fund managers that were coming to us saying they needed help solving some issues in getting these products to market,” Jokovic told AXIS.

Cboe Chief Commercial Officer Shane Miller says a good example is actively managed fixed income funds. Under ASX listing rules, an ETF can only invest in a bond if is within an index or issued by a listed company.

“The classic example is Sydney Airport, which is a listed company. If it issues a bond, there’s no problem. But Melbourne Airport is not a publicly listed company. If it issues a bond, it probably has a similar credit rating, and there are a whole bunch of fund managers in Australia in the fixed income space that would probably be happy to buy that bond. But you can’t include that bond in your ETF,” Miller said.

“So fund managers wanting to come to market with an ETF would have to change what was in their portfolio in order to meet the ASX’s rules. What we did, is we changed the rules in order to meet the fund, instead of making managers change the holdings of the fund to meet the rules. We developed a whole new set of rules so those types of funds could then list as an ETF on the exchange.”

Advisers driving demand

Demand is largely being driven by advisers, who have increasingly embraced ETFs in recent years. Annual surveys by research house Investment Trends, commissioned by BetaShares, found that the number of financial advisers recommending ETFs to clients has more than doubled over the past ten years.

A recent whitepaper from AUSIEX found that take-up of ETFs by advisers rose strongly during the COVID-19 pandemic as advisers sought efficient and timely ways to diversify portfolios and invest thematically in a rapidly evolving market.

The increased use of ETFs also relates to structural changes in the advice industry, as advisers move from big national dealer groups to set up their own businesses – and look to provide low cost, tax effective ways of investing to their clients.

Cboe Business Development Executive Bryan Richmond says research by the exchange has found that adviser uptake of active ETFs has been particularly strong:

“If you look at the general index-tracking ETFs, it is still very much dominated by the online retail space, but when you look at an actively managed fund, it changes completely. It’s more the wholesale space, which is your independent financial advisers (IFAs) and intermediaries trading through a dealer group, as well as the full-service advice space. It really does change the audience quite dramatically.”

Richmond said advisers tend to be more willing to pay a higher MER (Management Expense Ratio) for active management, and tend to employ the products when they seek to gain or increase exposure on behalf of their clients to an asset class that might be difficult to access through buying individual securities, such as fixed income or international markets, rather than Australian equities.

Active ETFs combine the benefits of active fund management with the convenience of share trading.

AUSIEX Head of Markets & Client Solutions Mathew Tilley says active ETFs have the potential to save advisers time and save on platform fees: “Just the execution of placing a trade is far easier than filling out a 30-page document to set up a managed fund.”

The new one-unit structure pioneered by Magellan allows advisers to move their client’s holdings between the on-market and off-market channels without triggering a capital gains tax event.

“The response from advisers has been overwhelmingly positive as more and more advisers move their clients into the listed world to help manage their portfolios in a better manner,” says Magellan’s Herbert. We think these innovations are going to lead to explosive growth in active ETFs in Australia over the next 5-10 years.”