Why quality investing is for 'all seasons': VanEck

Investing in, so-called quality companies, has been a focus for fundamental investors for decades. Since the 1930s, the characteristics of a “quality” company have been empirically tested, researched, and finessed. Benjamin Graham outlined the basis of a quality company in The Intelligent Investor in 1949. Such companies, he claimed, show resilience by falling less in a downturn and recovering to previous highs quicker than other companies.

AUSIEX spoke to Jamie Hannah, VanEck’s Deputy Head of Investments and Capital Markets, to understand more about quality investing, which he described as “an approach for all seasons.” He also explained his outlook for quality companies in an environment of slowing economic growth, higher interest rates, and strained company balance sheets.

One quality ETF, the VanEck MSCI International Quality ETF (ASX: QUAL), tracks the MSCI World ex Australia Quality Index, and screens for companies with high return on equity, stable year-on-year earnings growth and low financial leverage. Holdings typically include globally recognised names such as Microsoft, Apple, NVIDIA, Visa, and the Exchange Traded Fund (ETF) is among the most traded on the AUSIEX platform.

What is the investment strategy behind International Quality?

There are more than 1,200 international companies Australians can invest in, as per the MSCI World ex Australia Index. Not all are desirable from an investment standpoint and many investors want to know which are most likely to deliver outperformance over the long-term.

We looked to academic research to find the answer. Analysis shows that while quality does tend to behave defensively in downturns, it also tends to capture a fair share of the upside in bull runs.

QUAL tracks the MSCI World ex Australia Quality Index, which selects the highest quality international companies based on three key fundamentals: high return on equity, earnings stability, and low financial leverage.

How is that strategy reflected in the holdings — how different are they to a plain vanilla index fund?

Applying a quality screen and selecting the highest quality international companies not only results in fewer stocks (around 300 versus 1,200), but different sector weightings as well. The quality screen puts more weight into the most profitable, least levered companies. QUAL is overweight information technology, communication services, health care and consumer staples, and it is underweight financials, consumer discretionary, energy, materials, utilities and real estate.

Quality companies are essentially financially sound companies that have a history of solid earnings. One example is Netflix, which was added to the quality index in June 2021 at USD$528.21. Now, a little over four years later, it is trading at USD$1,220.08. In the MSCI World ex Australia Index, it has a weighting of 0.66%. In QUAL, it has a weighting of 2.2%.

QUAL has outperformed the MSCI World ex Australia index over the long-term by returning 14.75% p.a. over the past 10 years ending 30 September 2025 (compared to 13.14% p.a. for the MSCI World ex Australia).

It is primarily focused on capital growth, however there is generally a small dividend paid annually.

In what market conditions does quality perform best?

Analysis shows that while a quality investing approach tends to behave defensively in downturns, it also tends to perform strongly in bull markets. This is why quality investing is known as a strategy for ‘all seasons’.

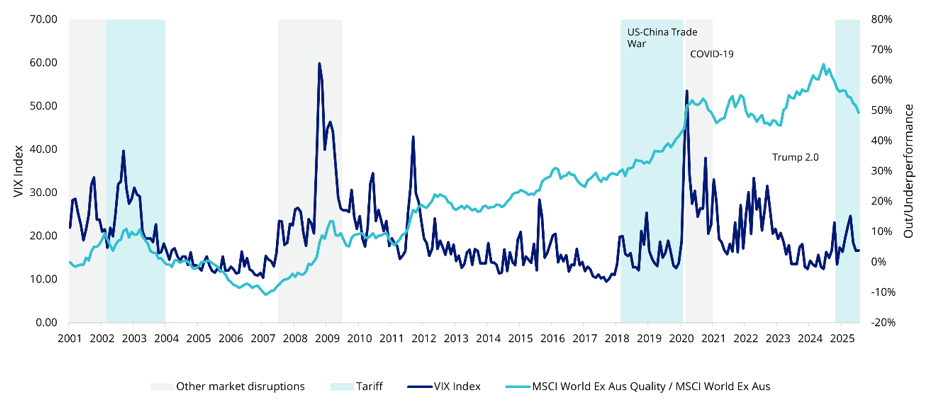

In times of heightened volatility and periods of stagflation, it has outperformed. In the chart below, when the light blue line is rising, quality is outperforming. Historically, quality strategies often outperformed when the Cboe Volatility Index (VIX) spiked significantly.

Global quality equities versus equity market volatility

Source: VanEck, Bloomberg. Performance in AUD. Data as at 31 July 2025. Past performance is not a reliable indicator of future performance.

Quality companies have also lost less and recovered faster during periods associated with market falls and deteriorating economic conditions, including the dot com bubble, October 2007 sell-off, and COVID-19 volatility.

Why should advisers consider a factor strategy as part of a portfolio?

Factor strategies allow advisers to target specific, proven drivers of return rather than relying solely on broad market performance. When implemented via an ETF, advisers can achieve cost efficiency, transparency, and ease-of-access synonymous with passive investing, with the potential for active-like outcomes.

The number one reason advisers use factor-based ETFs, also known as smart beta ETFs, is as a replacement or substitute for active management, according to the latest VanEck Smart Beta Survey.

Factor strategies can help advisers navigate the seasons of the economic cycle. ETFs that capture factors like quality, growth and value can be utilised by savvy advisers to either hold through the cycle, or blend, to help mitigate the troughs of the cycle.

What is your market outlook for the remainder of 2025?

The global share market rally may continue if earnings per share growth is sustained. This is despite the presence of several pockets of elevated valuations. Strong net beats during the 2025 Q2 US earnings season supported equity market growth through the quarter. Meanwhile, the US Federal Reserve rate cut in September 2025, and the recent trade deal announcements has improved policy clarity and investor confidence.

Market volatility may return. The rally in speculative assets has started to fade, which means a factor rotation could be on the horizon. Implications of potentially sticky inflation and elevated long dated bond yields are yet to be priced into equity markets. In the US, the impact of tariffs could translate to higher goods and business prices, potentially fuelling higher inflation. This could spark a ‘flight to quality companies’.

Company debt serviceability could become a focus of investor scrutiny as higher interest rates strain balance sheets in a slowing economic environment. Consequently, there could be increased demand for quality companies with lower financial leverage and more stable historical earnings growth.

Sign up to our monthly newsletter and never miss an article.

Disclosure / Disclaimer

These are the views of the portfolio manager at the time of writing and subject to change without notice. Not personal advice. All investments have risks. Read the PDS and TMD accessible at vaneck.com.au