Using Options to Repair a Stock Position

Lewis Taie, Senior Manager, Derivatives Program Download PDF

No one’s perfect. We’ve all had stock positions in our portfolio that haven’t performed as expected, where we’d simply settle to break even and live to fight another day. Even the oracle of Omaha, Warren Buffett, has had a few of these failed investments himself.

Now, for those of us who don’t quite have the track record of Buffett, we’re forced to look for alternate methods of trading in line with our views and searching for a “leg up” where we can find it.

So, what if there was a way to use Exchange Traded Options to break even, without the stock price getting back to your average purchase price?

The use of a “Stock Repair” strategy can potentially be a handy tool when managing your portfolio, providing a faster path back to break even, than simply holding stock alone.

As always, when trading Options there’s usually a trade-off involved. In this case, the trade-off comes from giving away the upside, should the stock price increase significantly. As such, it’s essential to consider the likelihood of a significant rally before employing the strategy.

Construction

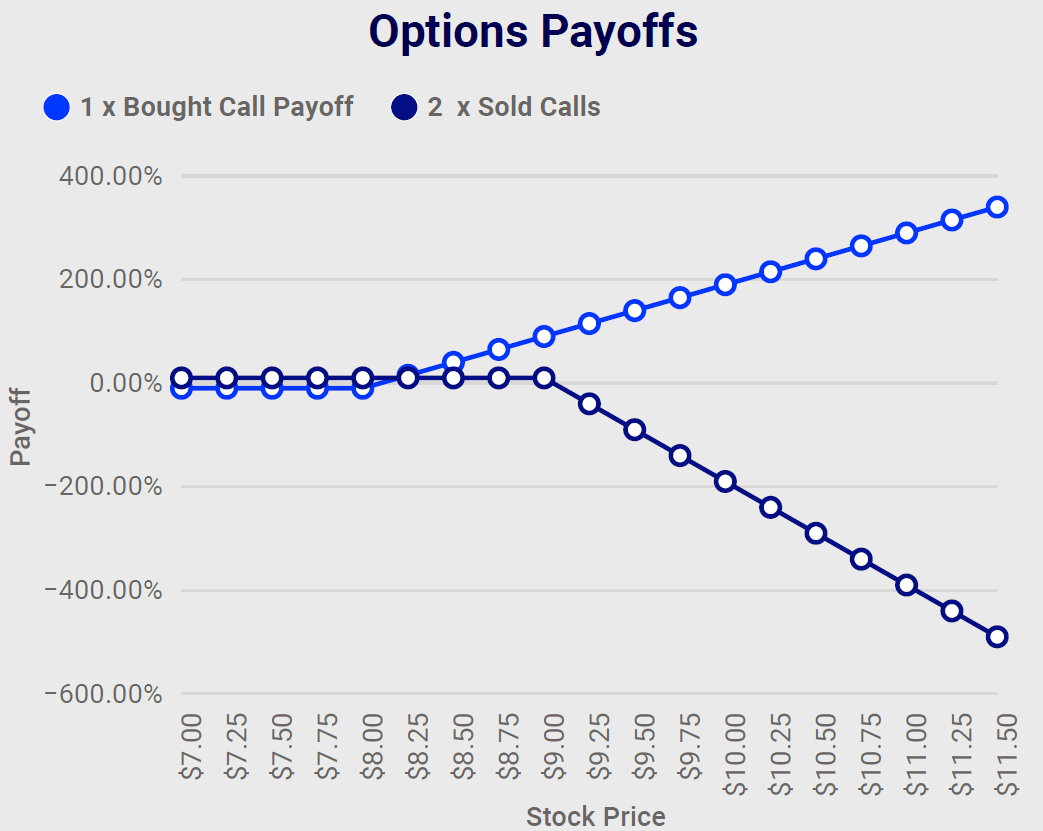

To construct the “Stock Repair” strategy, the investor will need to continue to hold the underlying stock and (for every 100 Shares) sell 2 “out of the money” Calls (strike price is above the current share price) while simultaneously buying 1 “at the money” Call (strike price at the current stock price).

The intention here is to have the premium received for selling the 2 Sold contracts offset the cost of the bought at the money contract, resulting in a zero-dollar outlay strategy if possible.

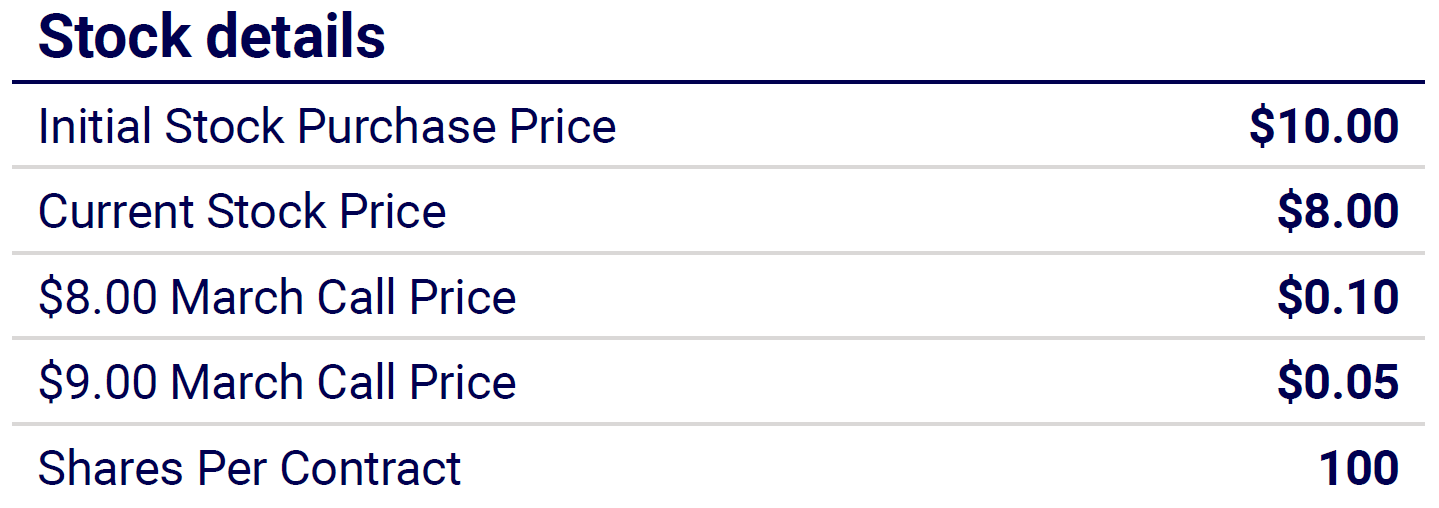

The worked example below assumes 100 shares have been bought initially at $10.00, though recent underperformance has led to a current price of $8.00.

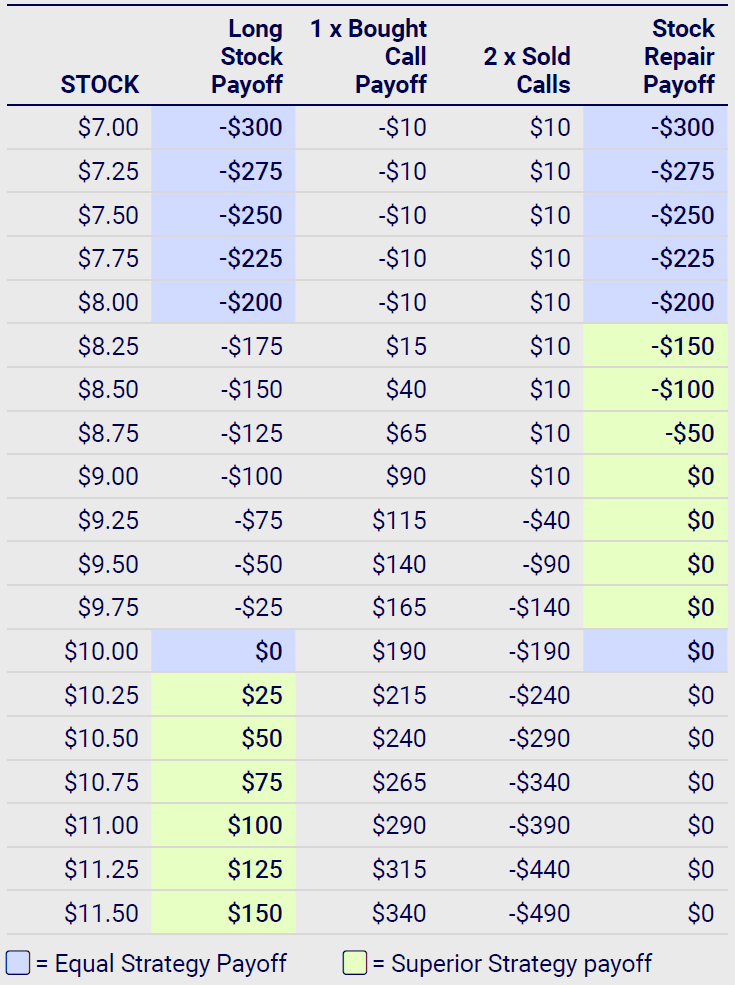

In order to repair the stock position, the client will buy 1 x $8.00 March Call for $0.10 and sell 2 x $9.00 March Calls for $0.05 each providing the below payoff schedule.

Note: The above construction assumes 100 shares per contract.

|

Data sources: AUSIEX |

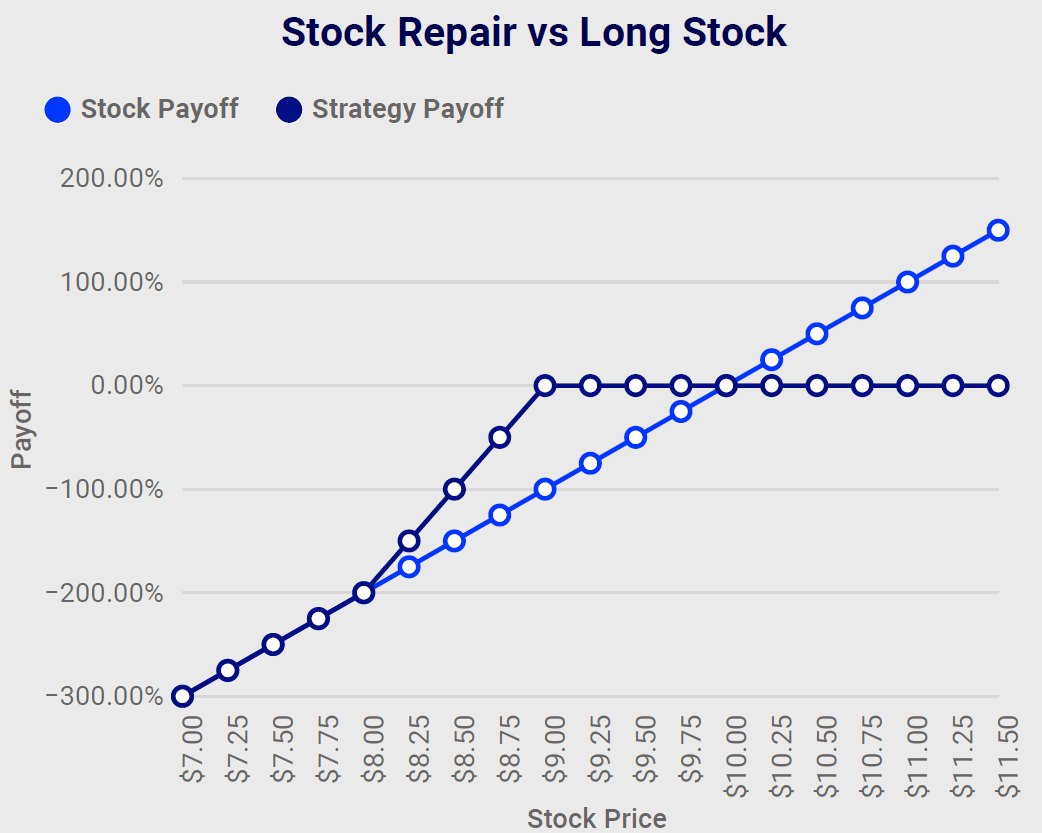

As shown in the resulting “Stock Repair vs Long Stock” payoff diagram and schedule above, the path to break even when using the stock repair strategy is significantly reduced, with breakeven now at $9.00, whilst the initial average purchase price was $10.00.

As alluded to, there is a trade-off, should the share price exceed $10.00, the client would receive a superior payoff simply by continuing to hold the stock alone.

Outcomes

Stock price < $8.00

Should the share price remain below $8.00, both the bought $8.00 Call and sold $9.00 Calls will expire worthless, with the investor retaining the stock. As the cost of the bought Call was offset by the premium received for the sold Calls, the investors payoff for Stock Repair vs Long Stock only is the same.

Under this scenario the investor would be indifferent to either strategy.

Stock Price Between $8.00-$9.00

Should the stock price increase beyond $8.00, the investor’s bought $8.00 Call will be in the money with the gains from the bought Call offsetting the investor’s unrealised loss on the stock position, enabling the investor to breakeven at $9.00 (as the $8.00 bought Call will have an intrinsic value of $1.00 at expiry when stock price is $9.00).

Under this scenario the payoff from the Stock Repair is preferable to just holding stock.

Stock Price Between $9.00-$10.00

When the stock price surpasses $9.00 the 2 x $9.00 sold Calls will move into the money. As any further gain from the stock holding and bought $8.00 Call will be directly offset by the loss from the 2 x Sold $9.00 Calls, the payoff for the Stock Repair remains flat, whereas the payoff for holding just the stock continues to improve in a linear manner towards the breakeven for the Long Stock @ $10.00.

Under this scenario the payoff from the Stock Repair is still preferable to just holding stock, as breakeven has been achieved for the Stock Repair, while Long Stock remains in negative territory until the share price reaches $10.00.

Stock Price >$10.00

Should the stock price exceed $10.00, the Stock Repair payoff will remain at breakeven, while the Long Stock only [position] will push into a profitable position. Under this scenario Long Stock is preferable.

Considerations

As highlighted by the change in preferable strategy at different stock prices, investors must weigh up the likelihood of a significant rally in the share price and the implications of foregone gains versus the lower breakeven point achieved when employing the Stock Repair strategy.

As with all options strategies, Investors must ensure they are comfortable with the relevant trade-off/s when deciding whether or not the strategy meets their needs.

AUSIEX provides a leading Exchange Traded Options offering for advisers and institutions. Contact us for more information.

IMPORTANT INFORMATION

This article contains general information for advisers only and does not take into account any individual objectives, financial situation or needs.

Australian Investment Exchange Limited (“AUSIEX”) ABN 71 076 515 930 AFSL 241400 is a wholly owned subsidiary of Nomura Research Institute, Ltd. (“NRI”). AUSIEX is a Market Participant of ASX Limited and Cboe Australia Pty Ltd, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Share Trading is a service provided by AUSIEX.

AUSIEX believes the information contained in this article is reliable, however its accuracy, reliability or completeness is not guaranteed and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the Competition and Consumer Act 2010 and the Corporations Act, AUSIEX disclaim all liability to any person relying on the information contained in this article in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. Persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives.

Any opinions or forecasts reflect the judgment and assumptions of AUSIEX and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this article are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this article is prohibited without obtaining prior written permission from AUSIEX.