Intergenerational wealth transfer set to accelerate

The intergenerational transfer of wealth in Australia is set to accelerate as we enter a period in which almost all Baby Boomers will have retired or be retiring and starting to distribute or decumulate wealth.

It’s true that real lives don’t always match the Baby Boomer and Millennial stereotypes that marketers, media and politicians love to talk about. Likewise, the wealth industry will adapt to changes that occur as Boomers retire and Gen X become the elders of the workforce, ahead of both Millennials and Gen Z.

Nonetheless, it is possible to gain a picture of the future trends that will shape the industry by using these general concepts as a useful tool for analysis and planning.

This will change demand for some investment products and services – and also for financial advice.

Time to retire

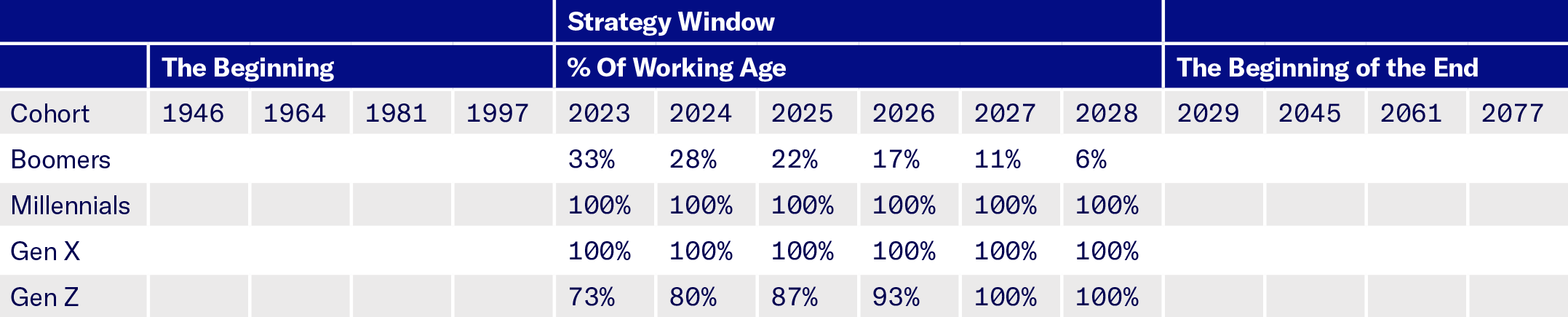

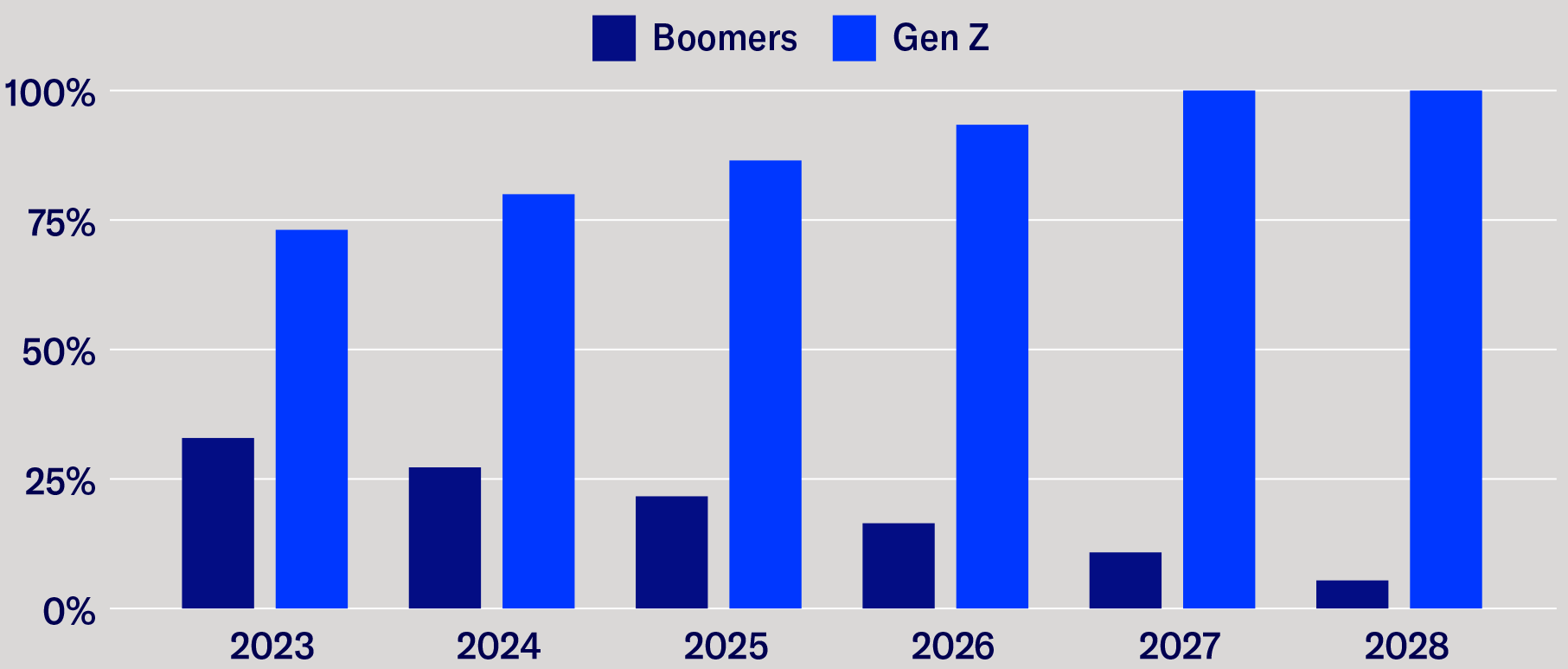

Using data from the 2021 census, within five years, all Baby Boomers will be eligible for retirement and the Baby Boomer bubble is expected to have all but left the workforce by 20281.

Table 2. Percent of Cohort of Working Age over 5 Year Strategic Window

It doesn’t stop there. In 2027, the first of the Baby Boomers will reach their statistical age of death2 (81 years for men, 85 years for women).

The impact on the wealth management industry is, firstly, that Baby Boomer superannuation balances will start to deflate out of the system through retirement consumption and then through disbursement via the inheritance process.

Secondly, Gen X are now the group preparing for retirement and will hold the largest balances in superannuation.

Thirdly, Gen Z will soon be fully deployed in the workforce and the predominant demographic groups needing to be serviced by the wealth industry will be Millennials/Gen Z.3

Generational birth dates

Source: ABS

Working age population (% of generation)

Source: Australian Census 2021

Why it matters for brokers and advisers

The decline and exit of the Boomers from the workforce mean that for the first time in its history, the superannuation system is going to see retirement phase withdrawals coming from its largest accounts. Those in the 60-64 age group have an average balance of $323,000 compared to the younger generations, where those in the 30-34 age group have an average balance of $45,0004.

While it is hard to predict how the money will flow from where, to whom, we can make inferences based on what we see in the data that we know today. If we start with superannuation balances, we find that the facts don’t really match the prevailing narrative that super is an inheritance tax planning device.

Research by the Association of Superannuation Funds of Australia shows that while it is true there are some very large accounts, Australian Tax Office data in 2018-19 showed there were only 322,200 accounts with balances above $1 million.5

This number will have increased given investment returns since that time, however the system favoured the older participants as they had the benefit of a period when contribution limits were not as restrictive as they are for today’s participants, and so the younger generations are less likely to be able to accumulate such large balances, in inflation adjusted terms.

Total benefits payments increased from $20 billion to $25 billion a year from 2018 to 2022. There was a net 3% decrease in total assets from 2021 to 2022 caused by volatility in financial markets – and withdrawals. At this time, the system is still in net positive contributions with positive inflows being supported by the mandated contribution level of 10.5%. This will increase by 0.5% every year until it reaches 12% from 1 July 2025.

Prepare for Change

Our industry has, and will continue to be able to, deal with change. This change is happening faster and with higher impact than many realise.

The older generations are about to leave the system, the younger generations face different challenges than those that came before them, and the transition to the digital world is continuing apace.

The wealth management industry and equity capital markets are proven at adapting to help the economy find new ways to create capital and increase wealth, but it is also essential that industry participants become more active in understanding and discussing the changes that are now taking place and engage across the value chain to plan and execute change.

Financial advisers need to prepare for change before the Boomer boom is over.

Download our white paper ‘The Precipice of Change’ for insights into how we see intergenerational change impacting on service delivery in the future and the role of technology.

2024 Update: An updated paper from AUSIEX, On the Precipice of Change: Preparing for Intergenerational Wealth Transfer, provides a detailed analysis of the potential impact on the industry and suggests responses that may be required.

1 https://www.abs.gov.au/statistics/people/population/population-census/2021

2 https://www.aihw.gov.au/reports/life-expectancy-death/deaths-in-australia/contents/life-expectancy

3 https://www.abs.gov.au/media-centre/media-releases/2021-census-shows-millennials-overtaking-boomers

4 https://www.superannuation.asn.au/ArticleDocuments/402/Superannuation%20Statistics%20November%202022.pdf.aspx

5 https://www.superannuation.asn.au/ArticleDocuments/270/2022_Superannuation_Account_Balances_Research.pdf.aspx