Industry response to climate change nears tipping point

The global economy is being impacted by several long-term trends that are disrupting business and remoulding markets. In a series of articles, we will update you on the impact these megatrends are having on investors and the asset management industry. The first megatrend we will explore is climate change and the need for rapid decarbonisation to prevent catastrophic impacts.

Megatrends have a powerful disruptive impact on every aspect of our world and play a major part in defining our collective future. Investors that ignore these long-term trends will fail to prepare for future risks. Those that do respond in a timely way can find opportunities to participate in innovation and new areas of rapid growth.

One megatrend at the forefront of investors’ minds today is the need for rapid global decarbonisation to prevent catastrophic climate change. According to the EY Megatrends report, decarbonisation is one of the most critical issues of our time, creating enormous risks for organisations that don’t adapt to its accelerating adoption.

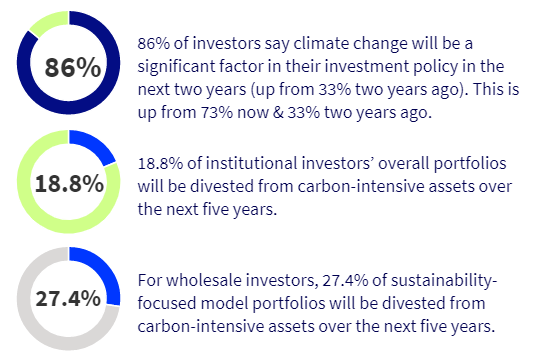

Research shows the focus of investors on the impact of climate change has intensified over the past year. A new study by asset management firm Robeco found that 86% of institutional and wholesale investors expect climate change to be at the centre of their investment policy, or a significant factor in it, in the next two years. That compares to the 73% that say climate change is already a significant factor, and is up dramatically from 33% two years ago.

Climate focused investing is approaching a “tipping point”, the report says, similar to the way environmental, social and governance (ESG) has in recent times become an integral part of investing that is applied through various approaches and across a wide range of asset classes. “Climate will become mainstream in our industry, with all assets being aligned with the net zero ambition at some point in the coming years,” said Christoph von Reiche, Head of Global Marketing & Distribution at Robeco.

Source: Robeco

The pandemic highlighted the need for stronger action in the face of global threats at the same time as the physical impacts of climate change became increasingly evident with events like the Black Summer bushfires in Australia in late 2019-early 2020.

Momentum in policy and regulations has been another key driver of the shift to environmentally sustainable investment, with China committing to a net zero target and the U.S. rejoining the Paris Agreement. Nearly 200 nations have now signed on to the landmark Paris accord and committed to limit their greenhouse gas emissions in an attempt to keep global warming below 2 degrees Celsius - preferably below 1.5 degrees Celsius - compared to pre-industrial temperatures.

To limit global warming to 1.5%, scientists say the world needs to reach net-zero emissions by 2050, requiring rapid, far reaching, and unprecedented changes in all aspects of society. For investors that means the opportunity to partake in the biggest economic transformation since the industrial revolution. It also poses a vast array of complex financial risks – from stranded assets and physical damage to infrastructure, to systemic impacts on industry sectors such as extraction and manufacturing.

Drivers for tackling climate change

|

Decarbonisation driver |

Proportion of investors that find this driver most relevant |

|

Increased use of renewable, bioenergy and hydrogen for power and fuel |

81% |

|

Switching transportation to low or zero carbon transport (e.g., electric vehicles) |

58% |

|

Replacing fossil fuels in industrial processes where possible |

56% |

|

Greater use of carbon capture use and storage |

27% |

|

Moving to circular economy |

25% |

|

Reforestation |

20% |

|

Reducing food loss and waste |

19% |

|

Reducing global consumption of livestock |

14% |

Renewable infrastructure investment to surge

One of the most popular ways of accessing the decarbonisation trend for institutions and wholesale investors is renewable energy.

Investment by Australian institutions in renewable infrastructure is expected to surge as regulatory change around the globe speeds up the shift to a low carbon future, according to financial consultant bfinance.

“As more and more investors in Australia commit to net zero carbon emissions by 2050, we expect the interest in renewables will only accelerate in order to meet stated carbon reduction targets. This is very much in line with the interest we are seeing in renewables from institutional asset owners globally,” said Frithjof van Zyp, Senior Director of bfinance’s Australian office.

Once a small niche of the infrastructure asset class, renewable energy investing has exploded globally in size and maturity. A report by bfinance, ‘Renewable Energy Infrastructure: Lessons from Manager Selection”, highlights the considerable growth in the number of funds available to investors in renewable energy infrastructure, with more than 65 strategies fundraising as of early-2021 compared with approximately 50 in 2019.

The increased competition has not reduced return expectations, however. Instead, the strategies available to investors have evolved substantially, with key trends including greater exposure to development risk, use of less conventional technologies, investing in new geographies and greater specialisation.

How institutional investors expect the disruption of COVID-19 to impact their investment strategy in renewable infrastructure.

|

Invest more capital |

55% |

|

Invest the same amount of capital |

33% |

|

Invest less capital |

3% |

|

Do not invest |

9% |

Source: LP Perspectives 2021

The renewable energy industry has grown significantly over the past decade, rising from about 10% of energy produce in 2010 to 22% as of November 2020, according to the International Energy Agency, and cost reductions and sustained policy support are expected to drive strong renewables growth beyond 2022. Overall, renewables are set to account for 95% of the net increase in global power capacity through 2025.

Climate ETFs to accelerate “tectonic shift”

In his 2021 letter to CEOs, BlackRock founder Larry Fink said the reallocation of capital into sustainable strategies has accelerated faster than he anticipated. He said he expects this “tectonic shift” in investor behaviour to accelerate as better technology and data enables asset managers to offer customised index portfolios to a broader group of investors, and as governments adopt meaningful policy responses to climate change.

Around the world, asset managers have begun launching new ranges of climate focused exchange traded funds (ETFs) that make it easier for individual investors to gain substantial exposure to the decarbonisation theme in a simple, low-cost way. A sample of those that hit international markets in in March 2021 includes a suite of equity ETFs from UBS aligned with the Paris Agreement’s most ambitious goal to limit global warming to 1.5% above pre-industrial levels, and two new fixed income ETFs from BlackRock that focus on climate aligned bond investments.

Locally, VanEck in March launched Australia’s first clean energy ETF. The VanEck Vectors Global Clean Energy ETF (ASX: CLNE) tracks the S&P Global Clean Energy Index, which has delivered a one-year total return of 116% as of 29 January 2021. The index attempts to represent the full clean energy ecosystem by capturing companies involved in renewable energy production and related technology, including biofuels, ethanol, fuel cells, geothermal technology and equipment, hydro electricity, solar and wind.

Meanwhile, BetaShares has launched the Climate Change Innovation ETF (ERTH), which aims to provide “holistic exposure” to companies that are transforming the way we generate, store and consume energy, as well as companies that offer products and services that drive energy efficiency or avoid carbon emissions altogether. Among the top companies held are Beyond Meat, DocuSign, Infineon Technologies and Zoom Video Communications.

BlackRock’s Fink noted that January through November 2020, investors in mutual funds and ETFs invested $288 billion globally in sustainable assets, a 96% increase over the whole of 2019. “I believe that this is the beginning of a long but rapidly accelerating transition – one that will unfold over many years and reshape asset prices of every type.”

Climate scientists often speak of a “tipping point”, such melting polar ice caps, that once reached could lead to a domino effect and accelerate the pace of climate change. 2021 may well be the year when investors mainstream climate transition analysis into their portfolios, and that may be a tipping point in which they become part of the climate solution.