How to get a strangle-hold on the market

By Lewis Taie, Senior Manager, Derivatives Program, AUSIEX

The US election is now behind us and there is now the possibility of promised corporate tax cuts being given the green light. Separately, the US Fed has indicated rates have peaked with Fed chair Jerome Powell stating1, “the time has come” (and has begun cutting interest rates), both of which may bode well for markets. While slowing Chinese growth and reduced consumption may well outweigh recent government stimulus measures leading markets lower.

So, what should local investors in international markets do?

International ETFs

Most investors are aware of how Exchange Traded Funds (ETFs) can be used to gain exposure to international equities, though the question for many investors uncertain on directionality is “how can I benefit from either a rally or pull back without one side being offset by the other?”

The use of options may provide a way for investors to maintain their share portfolio holdings through a period of potential turmoil.

In this case, the asymmetric payoff of exchange-listed options provides a perfect tool for benefiting from a sizable movement to either the upside or the downside. The ASX currently have three ETFs with international exposure that investors can trade Options over.

IVV: iShares S&P 500 ETFs

NDQ: BetaShares Nasdaq 100 ETF

VGS: Vanguard MSCI Index International Shares ETF

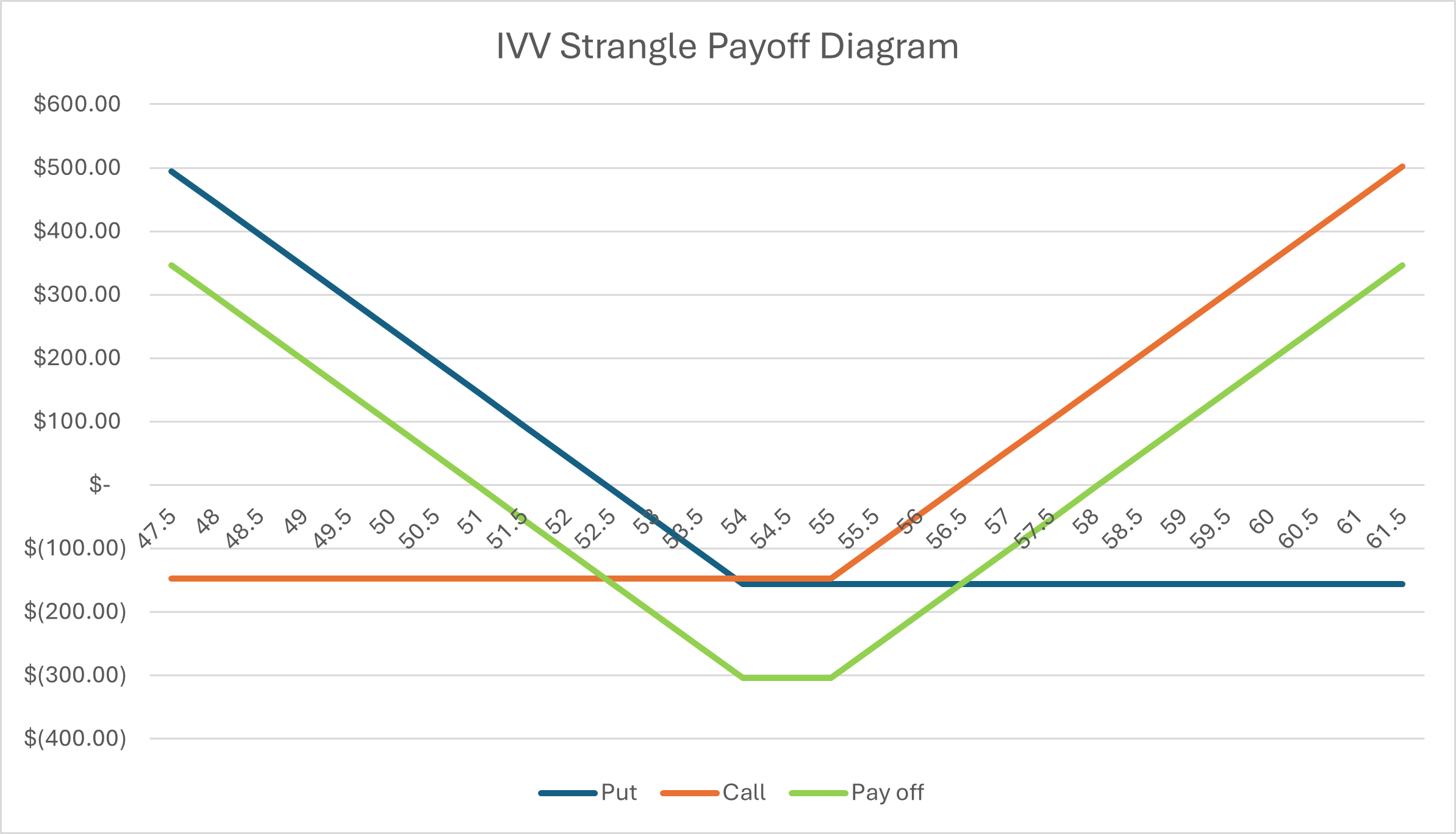

Here we will step-though the use of a Strangle strategy over IVV (iSHARES S&P 500 ETF), making use of simultaneously holding a bought Call and a bought Put, and how investors can benefit from a timely movement in either direction.

Construction:

Note: The below trade uses actual prices as at 12:30 PM on 6th September 2024.

To construct a long strangle, a Call will be bought with a strike price above the current underlying price while a Put will be bought with a strike below the current underlying price. In this worked example, we have used December 2024 contracts with an approximate 3-month expiry and with a strike price for our Call and Put at $55 and $54 respectively.

| Current IVV Stock Price | $54.50 |

| Buy 1 x IVVZN7 19-Dec-24 $55.00 European Call | $1.48 |

| Buy 1 x IVVZC7 19-Dec-24 $54.00 European Put | $1.56 |

| Shares Per Contract | 100 |

| Trade Cost* | $304 |

Pay off Diagram:

Pay off Schedule**

| IVV Price | % Underlying price change |

Trade Cost | Put | Call | Profit/Loss | %Return |

|---|---|---|---|---|---|---|

| $47.50 | -12.8% | $304 | $650 | $0 | $346 | 114% |

| $48.00 | -11.9% | $304 | $600 | $0 | $296 | 97% |

| $48.50 | -11.0% | $304 | $550 | $0 | $246 | 81% |

| $49.00 | -10.1% | $304 | $500 | $0 | $196 | 64% |

| $49.50 | -9.2% | $304 | $450 | $0 | $146 | 48% |

| $50.00 | -8.3% | $304 | $400 | $0 | $96 | 32% |

| $50.50 | -7.3% | $304 | $350 | $0 | $46 | 15% |

| $51.00 | -6.4% | $304 | $300 | $0 | -$4 | -1% |

| $51.50 | -5.5% | $304 | $250 | $0 | -$54 | -18% |

| $52.00 | -4.6% | $304 | $200 | $0 | -$104 | -34% |

| $52.50 | -3.7% | $304 | $150 | $0 | -$154 | -51% |

| $53.00 | -2.8% | $304 | $100 | $0 | -$204 | -67% |

| $53.50 | -1.8% | $304 | $50 | $0 | -$254 | -84% |

| $54.00 | -0.9% | $304 | $0 | $0 | -$304 | -100% |

| $54.50 | 0.0% | $304 | $0 | $0 | -$304 | -100% |

| $55.00 | 0.9% | $304 | $0 | $0 | -$304 | -100% |

| $55.50 | 1.8% | $304 | $0 | $50 | -$254 | -84% |

| $56.00 | 2.8% | $304 | $0 | $100 | -$204 | -67% |

| $56.50 | 3.7% | $304 | $0 | $150 | -$154 | -51% |

| $57.00 | 4.6% | $304 | $0 | $200 | -$104 | -34% |

| $57.50 | 5.5% | $304 | $0 | $250 | -$54 | -18% |

| $58.00 | 6.4% | $304 | $0 | $300 | -$4 | -1% |

| $58.50 | 7.3% | $304 | $0 | $350 | $46 | 15% |

| $59.00 | 8.3% | $304 | $0 | $400 | $96 | 32% |

| $59.50 | 9.2% | $304 | $0 | $450 | $146 | 48% |

| $60.00 | 10.1% | $304 | $0 | $500 | $196 | 64% |

| $60.50 | 11.0% | $304 | $0 | $550 | $246 | 81% |

| $61.00 | 11.9% | $304 | $0 | $600 | $296 | 97% |

| $61.50 | 12.8% | $304 | $0 | $650 | $346 | 114% |

Outcomes:

IVV Price < $51

Under this scenario, the Call will expire worthless, while the Put will expire in the money (as the underlying price is less than the strike). The intrinsic value of the Put ([Strike price – Underlying price] x Shares per contract) exceeds the value of the cost to implement the trade, leaving the investor in a profitable position.

IVV Price $51-$54

Under this scenario, the Call will expire worthless while the Put will expire in the money (as the underlying price is less than the strike). In this scenario the intrinsic value of the Put does not exceed the cost to implement the trade, and the investor incurs a partial loss if the position is held through to expiry.

IVV Price $54-55

Under this scenario, the both the Call and Put will expire worthless as no significant movement in either direction has come to fruition. As such, the value of the trade goes to $0 with a total loss incurred.

IVV Price $55 to $58

Under this scenario, the Put will expire worthless while the Call will expire in the money (as the underlying price is greater than the strike). In this scenario the intrinsic value of the Put does not exceed the cost to implement the trade, and the investor incurs a partial loss if held through to expiry.

IVV Price > $58

Under this scenario the Put will expire worthless, while the Call will expire in the money (as the underlying price is greater than the strike). The intrinsic value of the Call ([Underlying price – Strike price] x Shares per contract) exceeds the value of the cost to implement the trade, leaving the investor in a profitable position.

Additional Considerations

There are number of key considerations when assessing whether to employ a Strangle.

Firstly, a timely movement is required due to the effect of time decay on options. The longer the underlying stays neutral the greater the impact of time decay.

Secondly, as the strategy involves buying 2 legs where at least 1 will expire worthless, a notable movement is required for the trade to be profitable at expiry (in this case a movement of 6.5% in 12 weeks is required for the position to be profitable).

For these two reasons, a strangle can be useful when there is an upcoming announcement where the outcome is unclear, though the investor believes the outcome will introduce volatility.

Finally, it’s important to have an exit strategy and an understanding of what action you would take if the position moves either in or against your favour prior to setting the position.

Assumptions:

*Transaction costs are ignored for simplicity.

**The Payoff Schedule assumes positions are closed for the intrinsic value at expiry.

Conclusion

The use of options in this way may allow investors to profit from markets either moving up or down, capitalising on upcoming prominent decisions with known dates but unknown outcomes.

For more information on Options strategies or Options trading, please get in contact with a member of our Business Development team or call 1800 252 351.

Important Information

This article contains general information for advisers only and does not take into account any individual objectives, financial situation or needs.

Australian Investment Exchange Limited (“AUSIEX”) ABN 71 076 515 930 AFSL 241400 is a wholly owned subsidiary of Nomura Research Institute, Ltd. (“NRI”). AUSIEX is a Market Participant of ASX Limited and Cboe Australia Pty Ltd, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Share Trading is a service provided by AUSIEX.

AUSIEX believes the information contained in this article is reliable, however its accuracy, reliability or completeness is not guaranteed and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the Competition and Consumer Act 2010 and the Corporations Act, AUSIEX disclaim all liability to any person relying on the information contained in this article in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. Persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives.

Any opinions or forecasts reflect the judgment and assumptions of AUSIEX and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this article are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this article is prohibited without obtaining prior written permission from AUSIEX.

1https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm