How advisers can better help investors play the AI theme

Should investors buy direct shares of Nvidia, in particular, buy the dip when its inflated share price drops with market volatility, or take a different approach?

Investors recognise that the AI revolution is a transformative force in today’s economy, promising to reshape a range of industries.

The direct investment options are well known, with big names such as Nvidia dominating the headlines. However, with such stocks exhibiting high volatility, it may leave advisers with some challenges in terms of how to enter the market and how to integrate them into client portfolios. The risk profile of course may lead some to steer clear altogether.

So should financial planners advise their investor clients to invest directly in US stocks, the NASDAQ index or a tech fund? Or maybe suggest a local AI-focused ETF? Or recommend associated assets that support AI such as data centres, properties that host them or energy providers that power them.

John Lockton, Head of Investment Strategy at Sandstone Insights, notes, “Investors are increasingly considering one of the fastest adoption curves for any new technology with respect to AI.

He forecasts that the scalable nature of AI will likely see adoption move into the steepest part of the s-curve over the coming 12-18 months.

In the meantime, the volatility of AI stocks, such as NVIDIA, Alphabet and those harnessing AI, poses significant risks for unaware investors, especially those in or about to enter retirement.

Consider how at the end of January, Buzzfeed’s (US:BZFD) share price jumped over 200% after it announced it would be using AI to write articles. Those gains were short-lived, disappearing within a week. More recently, Buzzfeed closed its news division and fired 15% of its workforce, Investors Chronicle1 reported a few months later.

Financial advisers and their clients seeking exposure to the AI sector, might consider that there are a range of ways to access and diversify AI-related investments.

Direct investments risk portfolio volatility

Direct investments in AI companies include US-based stocks such as chip manufacturer Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOGL), or fellow semiconductor chip maker Qualcomm among others.

While these individual stocks can yield substantial returns they can come with high volatility. For instance, Nvidia's share price surged by over 120% in 2023 and was up 140% early this year to be, for a moment, the largest company in the world in terms or market capitalisation. But its share price has since retreated. How much higher can it go is uncertain.

“All generational technology shifts follow a general, the leader of each technological generation. Today, that general is Nvidia (NVDA),” Mr Lockton says. “Nvidia is the dominant manufacturer of AI chipsets and GPUs.

“In just 13 months, it became the fastest company to go from a $US1trillion market cap to $US3tr. Apple and Microsoft, by contrast, took ~5 years. What is more remarkable, in our view, is that Nvidia is exposed to a highly cyclical industry (semi-conductors), with a business model that generates almost no recurring income (and is unlikely to change in the foreseeable future). The explosive rise in the Nvidia share price (>6x since 4Q22) has been driven by the rise in EPS estimates, which have increased greater than six-fold at the same time.”

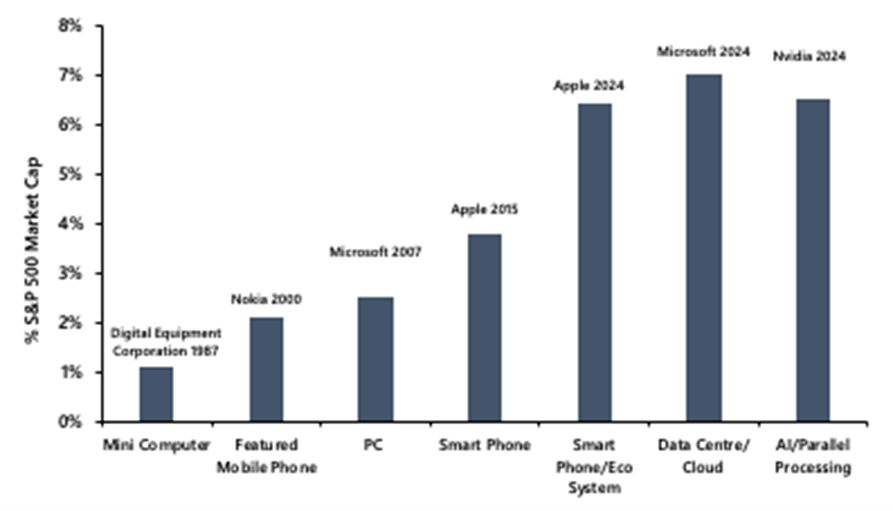

Nvidia dominates the generational computing era of 2024

Source: Company Data, LSEG, Sandstone Insights.

Each era of generational computing over the last four decades has seen a clear winner emerge. From Nokia in the 2000s to Microsoft in the PC era in 2007, to 2024, where dominance in US technology is across Apple (smart phones and related ecosystem), Microsoft (datacentre and cloud), and Nvidia (AI/Parallel Processing). These three companies alone speak to >20% of the S&P500 market cap.

ETFs offer diversified exposure

AI exchange traded funds (ETFs) provide broader exposure to a range of AI companies. These include US-based ones such as Global X Robotics & Artificial Intelligence ETF (NASDAQ: BOTZ) and iShares Robotics and Artificial Intelligence ETF (NYSEARCA: IRBO). The first AI ETF in Australia is Global X Artificial Intelligence ETF (ASX: GXAI) but there are also others providing integrated exposure in the form of Betshares Robotics and AI ETF (ASX: RBZ) and Global Xs’ Global Robotics ETF (ASX: ROBO).

Tech sector funds allow access to early adopters and sector beneficiaries

Broader technology sector funds, such as the Vanguard Information Technology ETF (NYSEARCA: VGT) and the SPDR S&P Kensho Intelligent Structures ETF (NYSEARCA: SIMS), include a mix of AI-focused companies and other tech firms beyond just AI.

Conversely, other sectors and sub-sectors relying heavily on manual processing or with lower levels of automation (such as logistics or healthcare) may also stand to benefit from outsized productivity gains through the application of AI technologies.

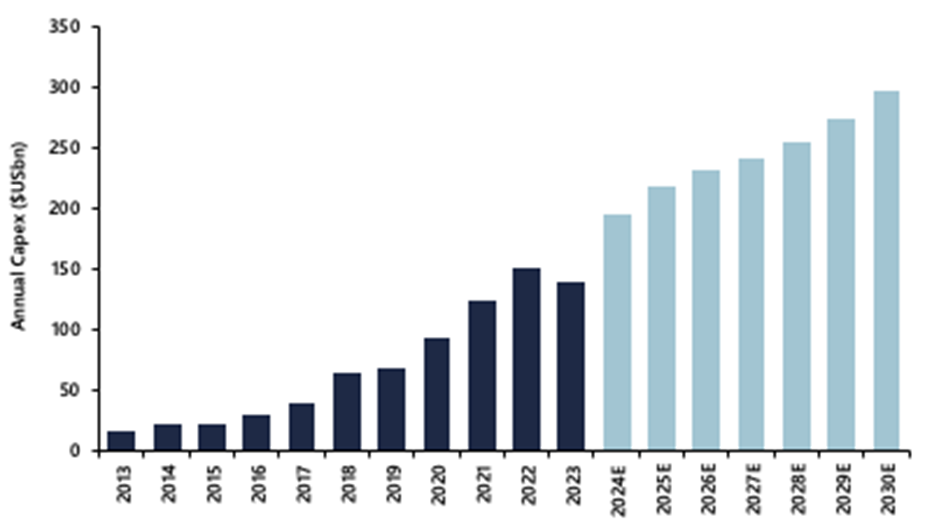

AI is driving large increases in CAPEX intentions from the hyperscalers

Source: Company Data, Sandstone Insights, Visible Alpha. Hyperscalers include Amazon, Google, Microsoft, Meta

AI infrastructure

Another way to play the AI theme is to invest in the infrastructure supporting its development, through companies involved in the production of semiconductors, cloud computing and data centres.

Semiconductor chip manufacturers include Taiwan Semiconductor Manufacturing Company (NYSE: TSM) and ASML Holding (NASDAQ: ASML) and Qualcomm.

A less direct approach is investing in Real Estate Investment Trusts (REITs) that focus on data centres that own and manage properties that house the servers and equipment essential for AI operations. Data centre REITs such as Equinix (NASDAQ: EQIX) and Digital Realty (NYSE: DLR) provide facilities for data storage and processing.

Another approach is a mix of these investments. Investing in the AI revolution does not have to mean riding a roller coaster. By diversifying across managed funds, ETFs, infrastructure investments, REITs, international markets, and commodities, financial advisers can offer their clients smarter, more stable ways to benefit from the transformative power of AI.

Mr Lockton adds, “In our view, the key to judging when we are close to the peak in the 'investor hype cycle' or the relative share price performance (relative to S&P500), is when the general - Nvidia (and the other foot soldiers – locally that names like Goodman Group (ASX:GMG), Macquarie Telecom (ASX:MQG) and Next DC (ASX:NXT) see their share prices stop going up on good news. That's a sign that the market telling investors that all the good news is now captured in the share price.

“The NVDA second quarter of 2024 results due 21 August are critical juncture for investors to assess where we are in the ‘AI hype cycle’,” he suggests.

Advice will obviously vary for each individual investor given their risk tolerance and individual situation – and what different approaches can provide.

Another option

AUSIEX notes there is also potentially the option of using protective puts over stocks that are at risk of AI disruption or puts on those expected to rise to amplify gains.

Never miss an article - sign up to the monthly AXIS email newsletter.

1 https://www.investorschronicle.co.uk/ideas/2023/04/27/how-to-play-the-artificial-intelligence-boom/