Green is good, say Australian traders

Australian investors have put a tidal wave of money into ESG-related securities and the trading value of equities and ETFs in this space has grown 134% since January 2019, according to the data analysis from AUSIEX.

AUSIEX is one of Australia's leading agency brokers for equities and ETF trade executions and traded $55.25 billion of the total Australian market in FY2021.

Confirming an emerging trend first identified in our AXIS article from November 2021, AUSIEX recently analysed the trading value of direct equities and ETFs strongly associated with hydrogen, battery tech and clean tech, as well as broader sustainability themes between 2019 and May 2022. In total dollar value, trading in ESG-related securities during the first five months of 2022 has nearly equaled the entire year of 2019; to date this year, $1.04bn has been traded compared to $1.26bn traded in 2019.

AUSIEX CEO Eric Blewitt said that while trading volume was highest in November 2021, around the time of COP 26 in Glasgow, strong momentum has continued. “2021 was the biggest year thus far with nearly $3bn worth of trades in ESG-related securities; this was more than a $1bn increase in 2020."

“So far this year, against a backdrop of rising inflation, monthly ESG trading figures have not been as high as 2021, but are still well over 100% above 2019.”

Young fancy ETFs, older favour shares

ETFs are the preferred method of investing for Millennials and Generation Z to gain ESG-related exposure. Generation Z represented 12.33% of total investors, making them the highest of all age groupings, followed by Millennials at 7.42%. A large portion of the trading has been in ETFs such as BetaShares Australian Sustainability Leaders (ASX: FAIR and ASX: ETHI) AND from 2021, a raft of new ESG-related ETFs have come onto the market.

Generation X and Boomers are more likely to invest in shares which may suggest they are seeking to directly influence or support specific ESG-related company activities.

Hydrogen the focal point for investments

Hydrogen investments were the most popular green sector across all generations of investors followed by the broader sustainability themed investments. It represented around 80% of all ESG-related trades placed between 2019 and May 2022.

The strong interest in this sector may have been driven by commitments by the former Federal Government in early 2020 to invest in building a domestic hydrogen industry as well as high profile private sector initiatives.

Among the most traded hydrogen securities were ADX Energy (ASX: ADX) and Environmental Clean Technologies (ASX: ECT).

Battery and clean tech strengthening

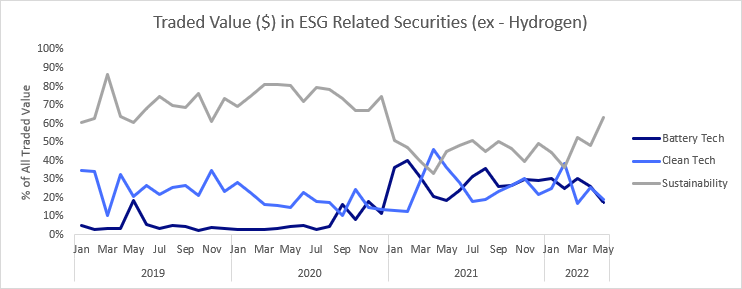

During 2021, trading in battery and clean tech securities began to challenge trading in broader sustainability-themed securities.

Graph: Traded Value in ESG related securities by AUSIEX (2019 - May 2022)

“The traded value in battery tech picked just ahead of COP26 and grew strongly into 2021,” Mr Blewitt noted.

Battery and clean tech found favour particularly with Boomers and Millennials vis-à-vis Generations X and Z investors who opted more for broader sustainability-themed investments.

Table: % of ESG-related securities trades and by Age Grouping (Jan 2019 to May 2022)

|

Generation |

Boomers |

Gen X |

Millennials |

Gen Z |

|

Battery Tech |

27.14% |

27.61% |

28.53% |

22.64% |

|

Clean Tech |

38.10% |

28.74% |

43.82% |

36.73% |

|

Sustainability |

34.76% |

43.65% |

27.65% |

40.62% |

Some of the most traded securities included Ecograf (ASX: EGR), Rediflow, (ASX: AFX) and Carnegie Clean Energy (ASX: CCE).

Retail investors were more likely to invest in battery and clean tech securities compared to advised clients (directly advised or via wrap platform) who selected broader sustainability-themed investments.

“COP 26 affirmed the leading role the private sector will need to play to help reduce global warming. Given this as well as the likelihood of greater focus on climate action because of the recent Federal Election, it is likely Australian investors’ interest in ‘green’ securities will grow even more dramatically,” added Mr Blewitt.

Australians put their vote where their money is

A strong correlation between trading in ESG-related securities and voting patterns in the recent Federal Election was observed.

There was strong ESG-related trading behaviour in the lead up to the Federal Election in suburbs that voted ‘Teal’ independents into Parliament on 21 May 2022.

Teal candidates won nine seats representing six per cent of the 151 seats in the House of Representatives.

Trading data between 1 January 2021 (when Climate 200 activity commenced) to May 2022 shows that ESG-related trading by investors living in the nine Teal seats was 14% of overall trading volume and 16% of overall trading value. A total of 2,922 trades were placed on average in the Teal seats belonging to 819 investors worth $70.3m.

This means seats won by Teal candidates contained on average 200% more investors trading ESG-related securities, and 151% more trades placed which were worth 188% more value when compared to other Electoral Divisions.

“This is an interesting observation and seems to suggest that Australians are using their power as investors to express their values, not just investing in green sectors for potential return. If this continues, by the end of May 2022, we will have seen more traded value ($) in Climate and ESG Related Securities in the first 5 months of the year compared to all of 2019,” said Mr Blewitt.

AUSIEX recently co-hosted a national webinar alongside Australian Ethical, Cboe and Elstree. For more general information in relation to ESG investing you can access our recording here.