Global versus local: emerging markets re-emerge

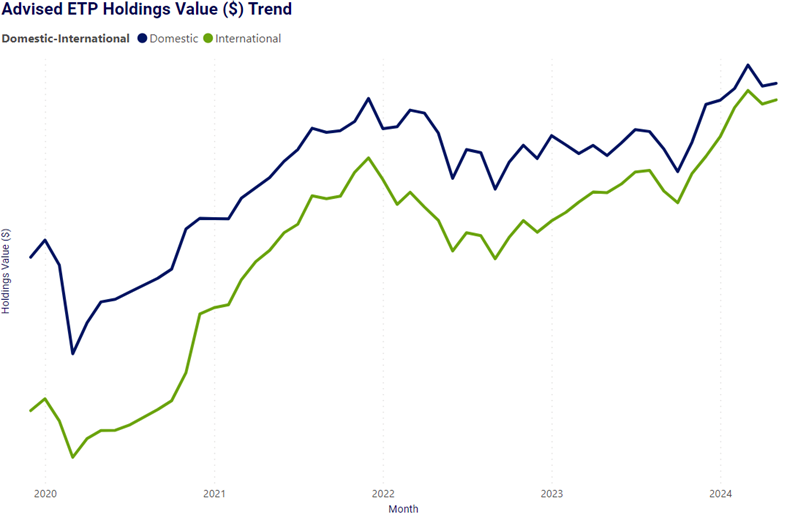

Australian individual investors’ traditional holdings of domestic ETPs, now only slightly outweigh those of internationally focused ETPs, according to AUSIEX data.

One reason is the well documented increase in interest in US stocks following the rise of tech stocks and more recently the ‘magnificent seven’ attracting more Australian retail investors to US markets.

This is expected to continue with the increasing interest in and expected surge in the use of artificial intelligence (AI) which has been echoed by the rise of chip-manufacturer NVIDIA, to be one of the world’s largest companies in terms of stock market listed value.

Emerging interest

While the interest in US markets is expected to continue, financial advisers and AUSIEX trading data, report that local investors are increasingly looking beyond the US.

Recently, there has been an upturn in interest in Emerging Markets (EMs) among many advised clients and SMSFs through emerging markets exchange traded funds (ETFs).

According to AUSIEX data, the trade in emerging markets ETFs by advisers, spiked in April 2024 with a 212% increase month on month from March 2024 by number of trades and 286% increase in traded value. While it retreated in the following month in May, trade volume and value were well above the longer-term average, notes the AUSIEX data.

Interestingly, over 70% of the number of trades of emerging markets ETFs have been advised SMSF accounts (compared to non-SMSF accounts) and with the majority being Baby Boomers (61%) and Gen X (26%). From a ‘life stage’ or wealth accumulation perspective, the majority were retirees (53%) but younger investors in ‘accumulators’ were also trading this theme.

The top ETFs, in terms of holdings by advised clients included iShares MSCI Emerging Markets ETF (ASX:IEM), Vanguard FTSE Emerging Markets Shares ETF (ASX:VGE), VanEck MSCI Multifactor Emerging Markets Eq ETF (ASX:EMKT), Fidelity Global Emerging Markets Fund (ASX:FEMX) and Betashares’ Martin Currie Emerging Markets ETF (ASX:EMMG).

Traded value (for advised clients) in emerging markets was also up 16% for the first quarter of this year, compared to the previous corresponding quarter, according to AUSIEX data.

It is not only Australian investors. Some of the world’s largest fund managers are returning to emerging markets. Schroders, for example among others, recently said it was looking past US equities for the first time in many years in favour of some emerging markets.

Top Advised ETP Security Holdings - Country Strategies (Ranked)

| Code | Description | Strategy |

|---|---|---|

| IVV | iShares S&P 500 ETP AUD | Equity - USA |

| VTS | Vanguard US Total Market Shares Index ETF | Equity - USA |

| IHVV | iShares S&P 500 ETP (Hedged) | Equity - USA |

| NDQ | Betashares NASDAQ 100 ETF | Equity - USA |

| IJH | iShares S&P Mid-Cap ETF AUD | Equity - USA |

| IJR | iShares S&P Small-Cap ETF | Equity - USA |

| IIND | Betashares India Quality ETF | Equity – India |

| IZZ | iShares China Large-Cap ETF | Equity – China |

| IJP | iShares MSCI Japan ETF | Equity – Japan |

| F100 | Betashares FTSE 100 ETF | Equity – United Kingdom |

Source: AUSIEX as at 25/6/2024

Top Advised Holdings – Country Strategies (Ranked)

| Strategy |

|---|

| Equity – USA |

| Equity – India |

| Equity – China |

| Equity – Japan |

| Equity – United Kingdom |

| Equity – South Korea |

Source: AUSIEX as at 25/6/2024

Top 5 International ETP Holdings by Advisers (Ranked)

| Code | Description |

|---|---|

| VGS | Vanguard International Shares ETF |

| IVV | iShares S&P 500 ETF |

| IOO | iShares Global 100 ETF |

| QUAL | VanEck MSCI International Quality ETF |

| VGAD | Vanguard MSCI Index International Shares (Hedged) ETF |

Source: AUSIEX as at 25/6/2024

Turnaround

The renewed interest in emerging markets is a turnaround from the previous decade, when reduced investment reflected poor emerging market stock performance. Between 2011 and now, the MSCI World Index significantly outperformed the MSCI EM Index. This was in large part due to quantitative easing in the West and the cheap capital it provided to businesses in developed markets, ultimately culminating in substantial rises in US-based stocks over the past few years and to the record market highs there posted in the middle of this year.

However, that cheap capital has disappeared, and some investors are looking beyond the US, looking for what markets may now follow.

Some Fund Managers such as Abrdn are also considering whether emerging markets will be significant longer-term beneficiaries of the AI revolution, citing their relative lack of legacy infrastructure as an opportunity to move more quickly with the diffusion of the technologies and realise the benefits than more developed markets.

The best performing markets in the first half of this year (besides the US) include Istanbul, Taiwan and Japan. Whether they can continue to be through the second half of the year remains to be seen.

The role of politics

Analysts note that more than 75 countries have had or plan to hold elections this year and that the outcomes of those elections will each have an impact on their stock markets.

Consider the US, where it is speculated that if former President Donald Trump is victorious once again, this could see renewed trade confrontation and the re-introduction of tariffs on imports along with a more aggressive posture toward China. Although specifics are uncertain, Trump has suggested a 60% import tariff on Chinese products and a universal 10% import tariff if re-elected.

How this impacts emerging markets is uncertain: but there will be winners along with losers as a result of the US, and other, elections.

China versus India

Interest in China as an investment destination has increased recently, as investors analyse whether the recent decline in markets could be due for a rebound.

India has also been popular for analysis as investors speculate that it could echo China’s economic growth over the past few decades. However, some fund managers note that India is not as similar to China as some suggest. That said, India now hosts the world’s largest population with 1.428 billion people compared to 1.425 billion in China, according to the United Nations.

India’s benchmark index is up 25% over 12 months to end May, almost identical to the US’s S&P 500. By contrast, China’s Shanghai Composite index has dropped 6.3%, Hong Kong’s Hang Seng is down 6%.

Does this mean that China is cheap or that India is a better investment. How you look at investing in emerging markets can be a matter of what factors investors look at – value, quality, a mix or something else.

Or to manage the risks of direct exposures to these markets, should Australian investors gain exposure to China through Australian resources companies, such as BHP and Rio Tinto, which rely heavily on China demand.

Whatever approach, Australian investors are increasingly looking at alternative markets for returns and where uncertainties, such as sticky inflation and political volatility, are less of a concern.

AUSIEX enables institutions, advisers and wholesale investors to directly trade offshore and provides an integrated international trading solution to provide access to international equities and exchange traded funds (ETFs).

Source: AUSIEX as at 25/6/2024

Get in touch to talk about how we can partner with you to help grow your business and the wealth of your clients.